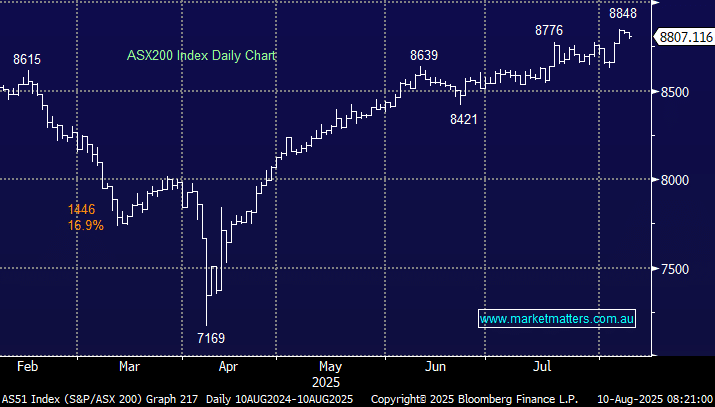

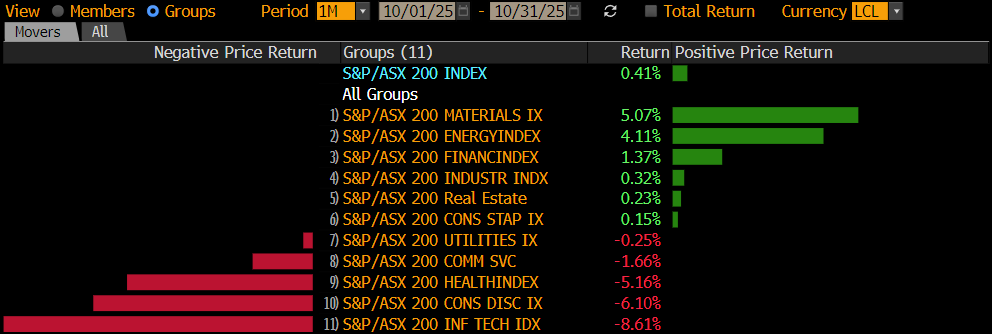

China’s export growth unexpectedly accelerated last month in the fastest gain since April, as demand from around the world compensated for the continued slump in shipments to the US. The materials sector rallied accordingly, gaining over 5% with gold, lithium, copper, rare earths, and iron ore names all joining the party. We’ve said for a while that the resources could be the last piece of the bullish puzzle to drop, driving the ASX200 up towards the psychological 9000 area – this is feeling more likely by the week. The local market expects another sugar hit this week, with the RBA set to cut interest rates by 0.25% on Tuesday. Futures markets are so confident that they are pricing in more chances of two cuts than none! The trend is now bullish until the market closes under 8775 – we may have adopted a neutral stance a touch early.

- On Saturday morning, the SPI Futures were calling the ASX200 to open up +0.1%, largely ignoring BHP’s 30c gain in the US and a strong session on Wall Street.