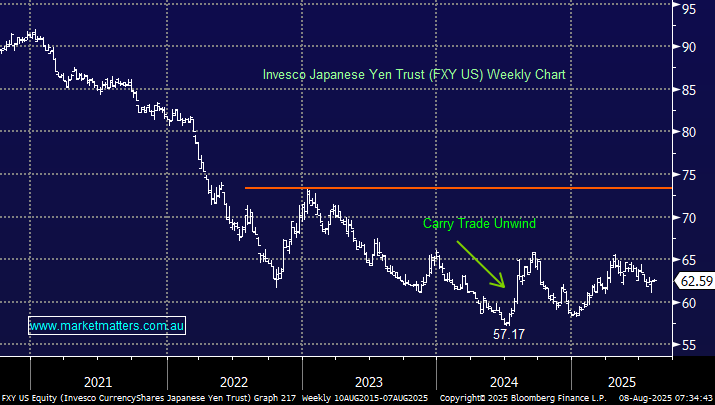

We could have chosen a number of currencies to hold as a bearish proxy for the $US; we chose the Yen as the BOJ started increasing interest rates for the first time in 17 years in March 2024. It’s likely to be a slow journey, but the markets have shown their hand. The Invesco Japanese Trust is a good way to gain exposure to a strengthening Yen. We deliberately chose a Trust due to its difference from an ETF.

An ETF and a Trust can look similar at first glance. Both hold assets for investors and can be traded on an exchange, but they differ in structure, regulation, and purpose. All ETFs in Australia are trusts, but not all trusts are ETFs! ETFs are designed for easy, liquid exchange trading; trusts can be much broader and less liquid. In this case, the FXY Trust trades in the US and is liquid, with a market cap approaching $US$600 million.

- We like the risk/reward towards this Trust targeting 15-20% upside.