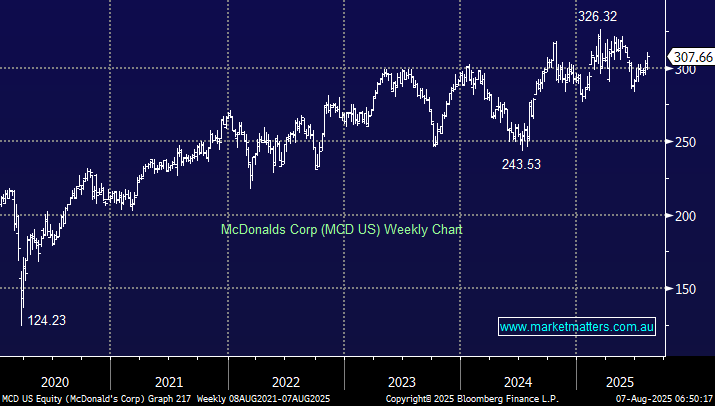

Fast food goliath MacDonald’s advanced 3% overnight after it delivered some solid numbers, reporting comparable sales for the 2nd quarter ahead of Consensus:

- 2Q comparable sales +3.8% v -1% YoY, well ahead of +2.5% estimates.

- Revenue of $6.84 billion, +5.4% YoY, ahead of $6.7 billion estimates.

- Adjusted EPS of $3.16 v $2.97 YoY, just beat $3.14 estimates.

This is another beat for an S&P 500 company supporting the market surge to new highs. The key to this result was customers spending more on average per visit, helping same-store sales increase by 4%.

- We like this MCD result and can see new highs into 2026, 8-10% higher.