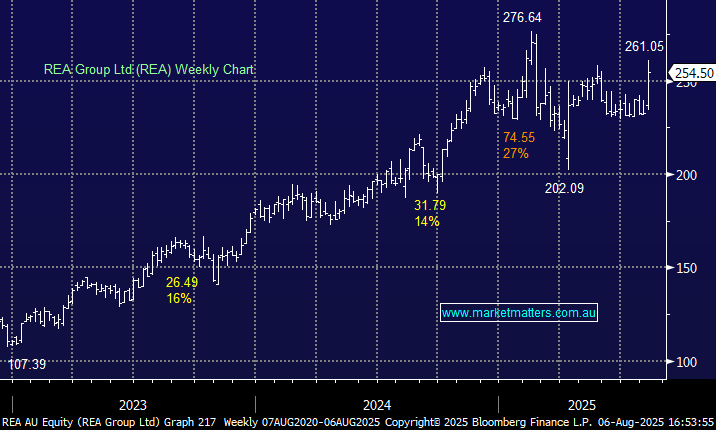

REA +6.94%: Strong session for the real-estate listings behemoth after they met FY25 expectations for earnings, though they bumped up the dividend and the commentary was very upbeat despite actual guidance around listing volumes appearing conservative.

- FY25 Revenue $1.67 billion, +15% y/y, estimate $1.67 billion

- Core Ebitda $943.3 million, +18% y/y, estimate $954.4 million

- NPAT $677.9 million vs. $302.8 million y/y, estimate A$634 million

- Final dividend per share A$1.38 vs. A$1.020 y/y

Margins improved and they talked to good momentum in the property market following a couple of rate cuts, with more on the way. They expect national residential Buy listing volumes to be broadly in line with last year’s healthy market, though 1Q listings are expected to be lower due to very strong comparables, with July listing volumes down 8% y/y, Sydney decreasing by 5% and Melbourne by 9%

The Group continues to target double-digit residential Buy yield growth with positive operating jaws targeted (revenue growth outstripping cost growth).

They do have some challenges though, which is keeping us on the sidelines, with CEO Owen Wilson stepping down after 6 years in the top job, with a replacement due to be announced in the next month, while CoStar has been given the green light to buy Domain (DHG), so REA will now have a much more dynamic and well-funded competitor – I’m sure plenty of Real-Estate agents are cheering.

- Good result, but we have no intention of chasing the stock.