- What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

- Market Matters Reporting Calendar: Australian FY25 Reporting Calendar in PDF Here & Spreadsheet Here

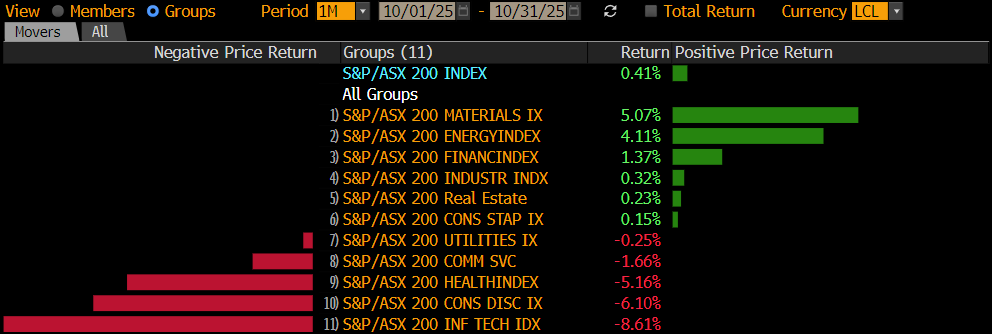

The ASX200 recovered from early losses on Monday to end the session in positive territory, an impressive performance considering the Dow’s more than 500-point drop on Friday night. The winners and losers were evenly matched, with a solid performance by the Materials Sector, ably supported by the markets’ defensive pockets, enough to offset a tough day for the influential financials. Considering the weak Jobs Report out of the US on Friday night, it was a relatively quiet session with only three stocks on the main board moving by more than 5%, and they were all gold stocks advancing on the prospect of lower interest rates, sooner rather than later.

Gold Stocks on Monday: Vault Minerals (VAU) +6.8%, Bellevue Gold (BGL) +6.5%, Northern Star (NST) +5.6%, Ramelius (RMS) +4.4%, Regis Resources (RRL) +2.7%, and Evolution Mining (EVN) +2.6%.

Elsewhere, the local market followed the action under the hood of the S&P 500 on Friday night, with weakness focused in tech and financials. The miners and defensives managed to leave the ASX200 up on the day, albeit just 2 points: Materials +1.2%, Consumer Staples +1.2%, and Utilities +0.6%. At this stage, we are looking for some consolidation by the ASX200 over the coming weeks/months, with more of the same from a stock/sector perspective. Still, our preferred scenario remains a ~3% pullback towards the 8400 area, but nothing more sinister, and we must not discount that the trend remains bullish until further notice, with local reporting season/earnings now becoming an influential factor – let’s hope Australian companies are enjoying the same tailwinds as their US counterparts.

Overseas markets were strong overnight as indices clawed back the steep losses endured on Friday night, which were sparked by concerns over the U.S. economy and a new round of tariffs from the Trump administration. In Europe, the EURO STOXX 50 surged +1% while the UK FTSE closed +0.7% higher. In the US, a renewed wave of dip buying saw equities halt a four-day decline with the S&P 500 finishing up +1.5% and tech-based NASDAQ +1.9%.

- The SPI futures are calling the ASX200 to open up 1% this morning, back within striking distance of its all-time high.