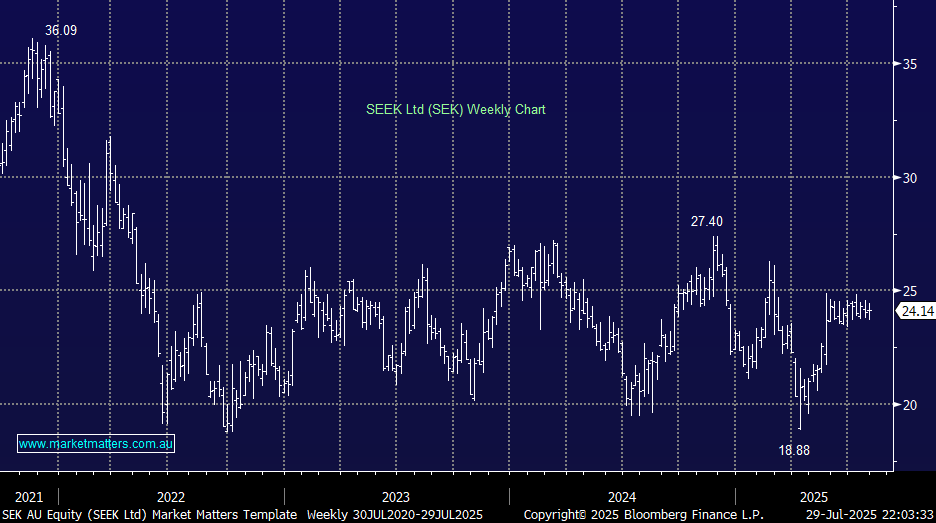

In a market full of rich valuations, SEK is trading less than 6% above its average forward P/E over the last two years and well below its five-year average, since job adds peaked in mid-2022:

- Online job ads peaked in mid-2022 and have since declined steadily. By late 2024, SEEK reported a 20% YoY drop in ad volumes, driven by softer hiring across hospitality, tech, and retail sectors.

- However, May’s -5.6% YoY decline is the narrowest monthly decline since Dec ’22, and they outperformed the ABS internet job vacancy index by 220bps (-7.8% YoY) for the month.

- ANZ‑Indeed data recorded a 1.8% gain in June, indicating a tentative recovery following the May dip, and SEK confirmed a continued uplift in July, with MoM growth for several job categories, though most still remained below 2024 levels.

SEK’s Australian listings volumes are still tracking lower, something like ~10% so far in FY26, which is why the stock is trading ~30% below its late 2021 high. However, we like tracking incremental changes in data and we’re seeing initial signs that we’re past the nadir, and if that proves correct, the stock could quickly re-rate on the upside. It feels like it’s waiting for the last piece of the puzzle before investors become believers, which could push the stock to trade nearer $30 as opposed to sub-$24. With US trade relationships improving over recent months and SEK’s largest marketplace (Aus) set for macro tailwinds driven by an RBA cutting cycle, we think there is a strong case for job ad volumes to increase into 2026

SEK is currently trading slightly cheaper than REA Group (REA), whose margins are being threatened by CoStar after its purchase of Domain. While SEK is not cheap, we do like the risk/reward over the coming year as tailwinds build and they continue to see benefits from their unified platform.

It’s hard to clarify AI’s impact on job ads as many people will be forced to re-skill as AI replaces many roles—we saw it with CBA yesterday. However, we don’t see too much impact across SEK’s three primary sources of revenue: healthcare and medical, trades and services, and IT and communication technology (ICT). The latter might even get a lift in the coming few years.

SEK is a quality business, but the next 10-20% move in the share price is likely to be determined by the economy: rate cuts, an upturn in job ads, and business/consumer confidence are bullish tailwinds. However, if the RBA remains stoically conservative and unemployment ticks higher, it’s likely to weigh on SEK. Our take is that the pros outweigh the cons, especially as SEK’s share price doesn’t come with lofty expectations.

- We can see SEK breaking out above $25 in the coming weeks/months – we have added SEK to our Hitlist for the Growth Portfolio.