The ETF’s top five holdings were homebuilding giants D.R. Horton (DHI), Lennar (LEN), NVR (NVR), PulteGroup (PHM), and Toll Brothers (TOL) with DHI and PHM both up over 10% on Tuesday. Even though the new home market has slowed a lot, with price declines in major markets like Texas and Florida, many of the biggest builders in the country continue to surprise Wall Street to the upside around how well they’re running their businesses in this tough environment. With results not as bad as many feared, especially around margins, the market has simply been too bearish.

Builders have been aggressively ramping up sales incentives and price cuts. In July, 38% of builders reported cutting prices, according to the National Association of Home Builders, the highest percentage since the group began tracking that figure in 2022. While these large incentives are expected to be around for a while, the activity they are creating helps suppliers of raw materials to the sector. Lower interest rates could be the catalyst for the next leg in the sector’s recovery.

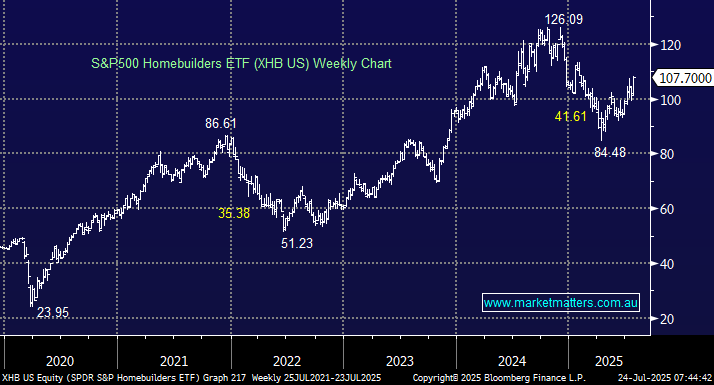

- We like the XHB, with a test of new highs a strong possibility.