- What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

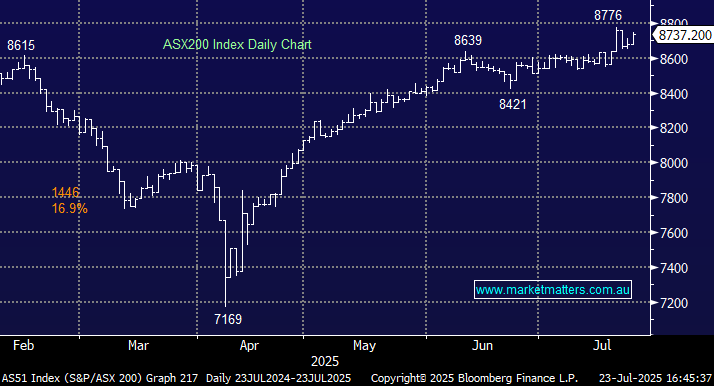

The ASX200 rallied +0.7% on Wednesday, closing back above 8700 and within 0.4% of its all-time high. Buying was broad-based, with over 70% of the index closing higher. Although Paladin (PDN) and Telix Pharma (TLX) delivered a couple of negative surprises, bullish sentiment continued to prevail with all of the big names from banks to resources advancing. The banks were back in the winner’s circle, while some profit taking crept into the heavyweight miners, although they still closed higher. Their outperformance over the last month has been dramatic:

- BHP Group (BHP) has surged over 19% while Commonwealth Bank (CBA) retreated 11% – a whopping 30% differential, and some reversion is to be expected even by the mining bulls.

Materials were the strongest of the 11 ASX sectors, with iron miners moving higher for the third session this week, bolstered by reforms to China’s steel industry. U.S. President Trump lifted the bullish sentiment after announcing a trade deal with Japan in a Truth Social post, which propelled the Nikkei up +3.5%, and indices across the Asia Pacific region broadly higher. Japanese media also reported that Prime Minister Shigeru Ishiba will step down from his role this month, easing market concerns of political instability after his party’s recent election losses. While details of the trade deal were thin on the ground, any reasonable agreement should help to defuse the impact and lessen the importance of the looming August 1 deadline.

- We’ve reiterated our bullish stance a couple of times while the ASX200 can hold above 8600, and the quick turnaround after Wednesday’s sell-off maintains this nice and simple trigger.

Overseas markets were strong overnight after the US reached a trade agreement with Japan, and reports crossed the wires that the EU and the US are progressing toward an agreement that would set a 15% tariff for most products. In Europe, the EURO STOXX 50 closed up +1% and the UK FTSE +0.4%. In the US, the Russell 2000 small-cap index led the line, gaining +1.5% while the S&P 500 advanced +0.8% posting another all-time high.

- The SPI Futures are calling the ASX200 to open up +0.3% this morning, back around the 8750 area, following strength on Wall Street.