Hi David,

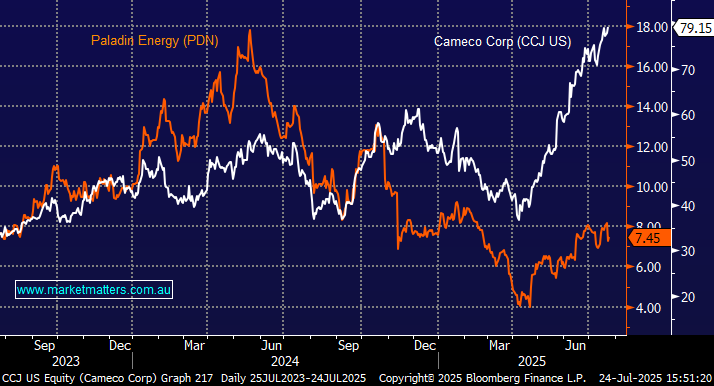

We met with L1 Capital’s Rafi Lam not long ago, who described PDN and the other Australian Uranium stocks as very low quality from an operational perspective, and uninvertible as a result, though they like the theme overall. We do hold Paladin (PDN) which has proven to be a huge underperformer in an exciting space as the chart below illustrates – wrong stock in the right sector. We also own Cameco (CCJ US) in the US which is at the other end of the spectrum, is a lot bigger, more diversified, and has executed well – the share price reflects that.

However, we spent time with the PDN CEO on Thursday, and after a rocky road, we are of the opinion that PDN will now enter a period of better operational performance, with a new and more operationally focussed CEO than the last.

- It may take time for PDN to emulate Cameco (CCJ US), the largest publicly listed uranium producer in the world by market capitalisation but we like the risk/reward around $7.50.

Rather than gravitating towards three alternative ASX uranium producers, assuming you agree with our bullish outlook on nuclear power/uranium we would defer to uranium ETF (URNM) which offers diversified global exposure for 0.69% pa – Deep Yellow (DYL) is its largest ASX position with a 5.1% exposure, placing it 5th by weight of the 42 holdings.

NextGen (NXG) is the other name we like in the space with a huge resource that will come online in a few years. A 3x stock exposure, mixed by size, geography and stage of development for us could be: CCJ, PDN & NXG, with Boss Energy (BOE) a potential alternative for PDN in this mix.