Hi Peter,

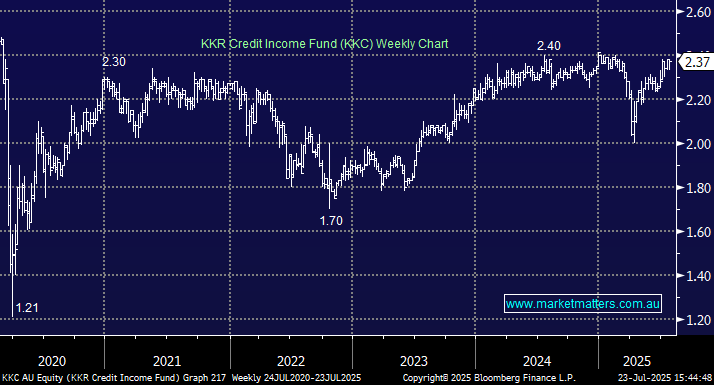

KKR Credit Income Fund (KKC): a yield-focused credit fund offering diversified global exposure through KKR’s expertise in credit markets, designed for investors looking for consistent income with some capital growth potential. The fund is currently yielding ~8.5%, based on a monthly distribution of $0.0167 per unit and a share price around $2.37.

- We think KKC is a good income fund, though they do have some lower quality credit in their portfolio, which are trading on historical low spreads, so it comes with slightly higher risk than some of the other LIT’s.

- We like DN1 which is more exposed to RMBS, and GC1 which is a mix. These are similar but slightly lower risk alternatives to KKC.

SmartGroup Corp (SIQ): we bought back into SIQ for our Income Portfolio in May attracted by the prospect of lower interest rates and the ongoing EV adoption driving volumes for the salary packaging and novated leasing company. We continue to like the risk/reward towards SIQ based on its conservative 13.3x valuation and attractive ~6% fully franked dividend yield, plus the distinct possibility of special dividends along the way.