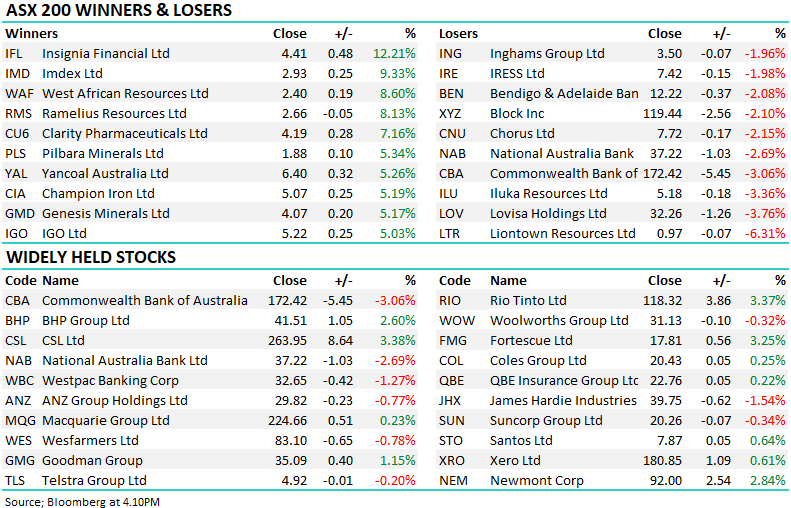

Over the first six months of 2025, Buffett’s Berkshire Hathaway has sold more than $US3.2bn worth of banks, including a $1bn exit of Citi, a $2bn cut in his Bank of America position, and a reduction in Capital One. As they trade towards their early 2022 highs, Buffett appears to believe the sector is over or at least fully priced. Local analysts have been calling the “Big Four banks” a sell for months on valuation grounds, but they’ve been led higher by market heavyweight CBA, which, as the MM site shows, currently has 11 Sells and 1 Hold on it. It’s not often that you see analysts so negatively aligned with the market’s largest bank, but even after recent weakness, it’s still trading more than 40% above its average five-year valuation.

It’s important that subscribers remember that large investors like Berkshire take a long-term view regarding month-to-month swings as largely noise and occasional opportunities to enter or exit positions. At MM, we like some of the specific banks, such as Goldmans (GS US) which delivered strong earnings numbers last week, and UBS (UBS US), but the easy money, if such a thing exists, does appear to be in the rearview mirror after the sectors push toward new highs with lofty valuations. We exited our CBA position in our Active Income Portfolio at the start of July and have no plans to beef up our banking sector in the near future.

- We can see the US banking sector posting new highs into Christmas, but the risk/reward isn’t compelling after their more than 40% advance since April.