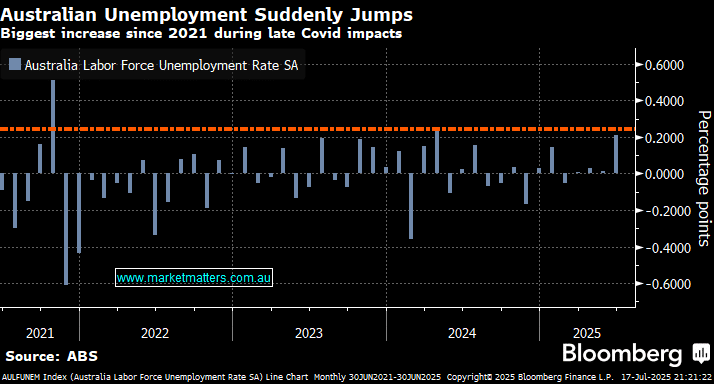

Yesterday’s weak employment data is important to RBA policymakers as the resilience of the labour market, and worries about it rekindling inflation, have been the key reasons why they’ve shown patience in the current easing cycle. Michele Bullock et al. have cut twice since the start of the year, but they shocked the market last week with a decision to hold at 3.85%, but Thursday’s weak jobs report, following a subdued reading in May, suggests the doves are now firmly in the ascendancy.

After its shock pause at 3.85%, the RBA said it wanted to wait for further evidence that inflation was sustainably hitting the midpoint of its 2-3% target. The quarterly CPI (inflation) report due on July 30th is seen as the major influence on its decision whether to cut in August. If it comes in vaguely soft, we believe the central bank will almost definitely cut in August after yesterday’s employment report.

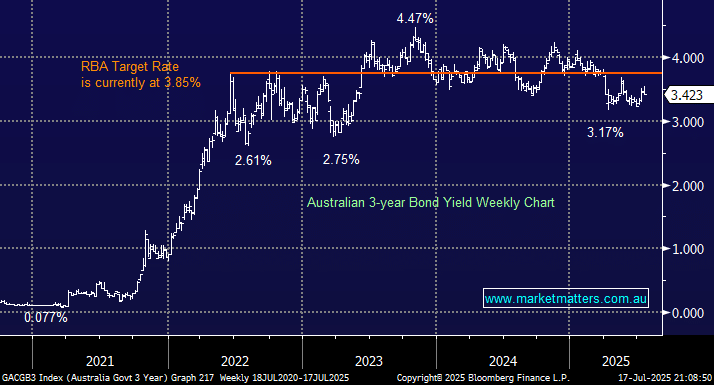

- We are expecting the RBA to cut interest rates by 0.25% on August 12th.

The RBA caught the market off guard earlier this month, delivering no rate cut when the futures market was pricing in a 97% certainty—the market was caught very wrong. At the time, Michele Bullock’s rhetoric was very much along the lines of when, not if, rate cuts would occur. Following the weak employment data yesterday, it’s hard not to see a 0.25% cut in August with more to follow, which should support equities into dips.

- We can see the local 3s rotating between 3% and 3.5% into Christmas as the employment data waivers.