- What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

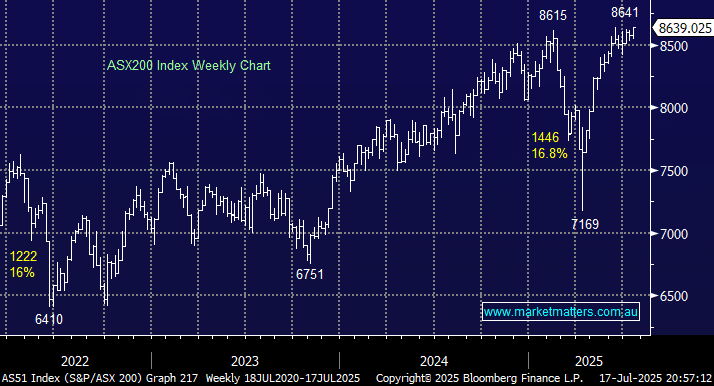

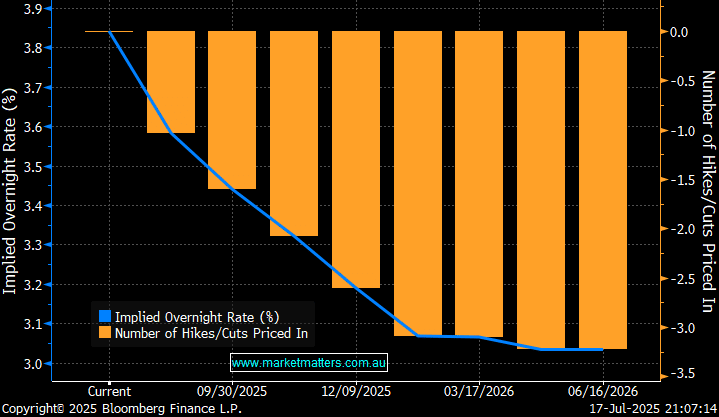

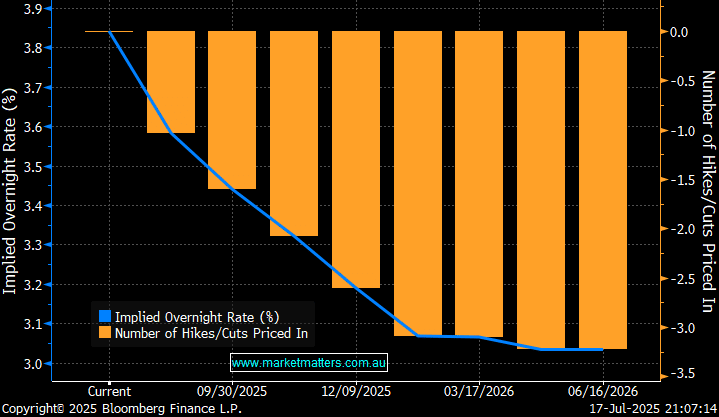

The ASX 200 closed up +0.9% on Thursday, posting both a fresh intraday and closing high. The catalyst being a surprisingly weak June jobs report, which increased the case for three rate cuts before Christmas – two were already being fully factored in. Australian unemployment unexpectedly climbed to a four-year high as hiring almost ground to a halt, sending the $A down by more than 0.5% in rapid fashion. The jobless rate increased to 4.3%, the highest level since November 2021, well above the expected unchanged rate of 4.1%. Traders are now factoring in a 60% chance of a 3rd rate cut into Christmas, a move that would take the cash rate down to 3.1%.

- We are looking for three rate cuts in the current easing cycle, although all of them coming before Christmas is the “Goldilocks” scenario.

MM believes rate cuts are coming, and Michele Bullock is likely to deliver some mortgage relief to millions in August—it’s looking like she was too conservative earlier this month.

All 11 major ASX sectors advanced on Thursday, but as would be expected, the rate-sensitive names came to the fore with the financials and real estate sectors both advancing by over +1.3%. The “Big Four Banks’ are looking well positioned to enjoy another leg higher, which could easily propel the index into our 8800-9000 target area – hence the subject of today’s ETF Report. Over the course of the last few weeks, sentiment has swung from three to two and now back to three rate cuts into Christmas, it’s not surprising that we’re witnessing lots of stock and sector rotation.

- We remain bullish towards the ASX over the coming months, but we still see plenty of polarisation on the stock/sector level.

Overseas markets experienced a strong session overnight, with most indices posting or toying with fresh highs. The EURO STOXX 50 and German DAX both closed +1.5% higher. In the US, the broad-based S&P 500 Index closed up +0.5%, with economically sensitive shares outperforming after solid retail sales and a drop in jobless claims. For good measure, after-market Netflix (NFLX US) reported strong earnings and raised its forecast.

- The SPI Futures are calling the ASX200 to open up ~0.5% taking the index within striking distance of 8700; BHP Group (BHP) closed up ~70c in the US ahead of production numbers this morning.