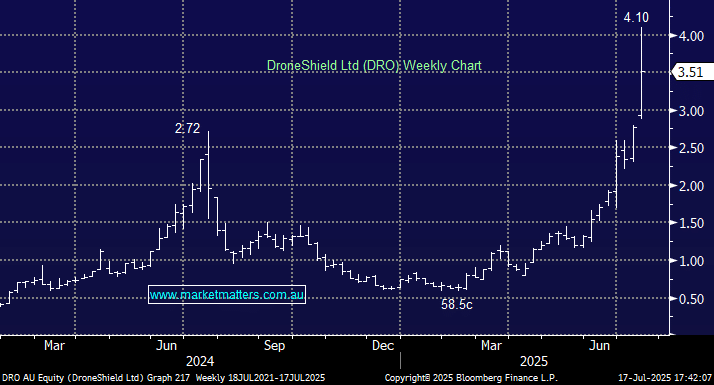

DroneShield Ltd (DRO)

I watched an interview with the DRO CEO on Ausbiz 14/7/25. What does he mean when he mentioned the large pipeline of orders for DRO? Are they potential businesses that the company bids for, with no certainty that it will lead to orders? I am puzzled by the spectacular rise in the share price following the announcement that the company will expand its production facilities. Am I missing something? I asked for clarification from the company, but I have yet to receive a reply. What is MM's valuation of the company? Does it justify its $3B valuation? Thanks & regards.