Morgan Stanley’s beat expectation overnight, and similar to other Wall Street banks, trading revenue was important, but they also had good results in their wealth management division which makes up around half their overall revenue i.e. it’s more important at MS than some others;

- Net revenue $US16.79 billion relative to $US16.04 billion consensus

- Earnings per share (EPS) $US1.82 versus $1.65 expected

- Wealth management net revenue $US7.76 billion beat expectations for $US7.35 billion

- Return on equity 13.9% against estimate of 12.7%

MS’s important wealth management unit reeled in $59.2 billion of net new assets in the period which shows good momentum in flows. Elsewhere, investment-banking fees fell 5% to $1.54 billion, a smaller drop than analysts expected due to a 42% increase in equity underwriting.

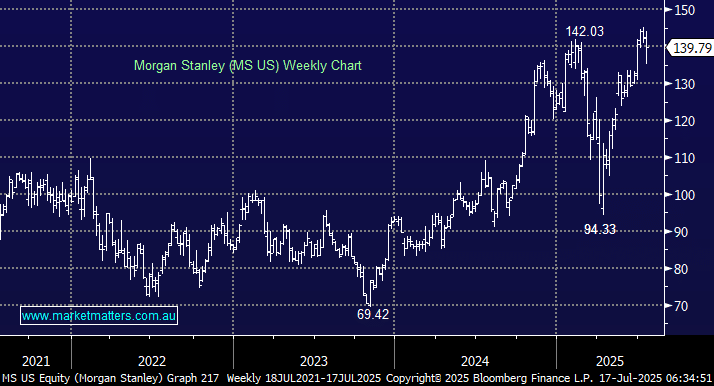

This was a great result, much like Goldman Sachs, yet the stock slipped overnight after a very strong run up over the past 6 months that now see it’s valuation on the higher side of history.

- We can see MS testing $US150 in the 2H, but upside momentum is waning.