Goldman’s stock traders posted the largest quarterly revenue haul in Wall Street history, as volatility sparked by the Trump administration’s trade war spurred a second straight record quarter for the unit. That drove a beat across pretty much all financial metrics:

- 2Q net revenue of $US14.58 billion, up +15% and comfortably ahead of expectations for $US13.53 billion

- Earnings Per Share (EPS) of $US10.91 compared well to $US9.77 forecast

- Return on equity was 13.6%, ahead of the 12% tipped.

Equity-trading revenue of $US4.3 billion for the second quarter was about $600 million more than what analysts were expecting and $US100 million above the first-quarter total. The firm’s fixed-income traders reported $US3.47 billion of revenue, supported by record results in FICC financing, while investment-banking fees jumped to $US2.19 billion. Both were well above consensus.

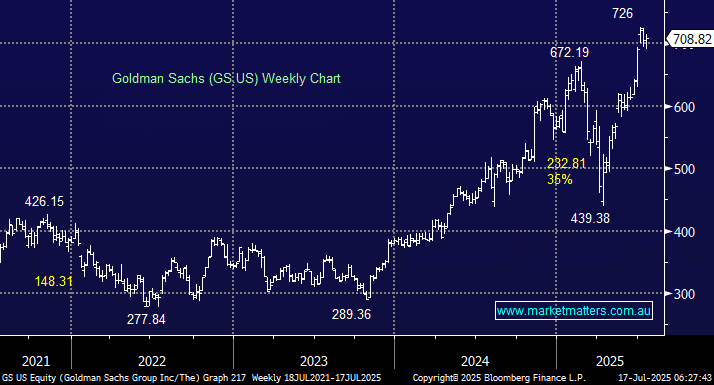

The stock was up 0.9% on the result and is trading at all-time highs. This was a big beat; however, trading revenue is seen as lower quality driver of earnings that are more volatile by their nature and are hard to quantify going forward. Equity underwriting was flat, while debt underwriting fell slightly due to a decrease in leveraged-finance activity. Total management fees in asset and wealth management — a key growth area for the bank — rose 11% compared to a year earlier, though net revenue dipped slightly to $3.78 billion.

- Overall, a great result and the stock looks on track to post new highs moving forward: MM holds GS in its International Equities Portfolio.