- What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

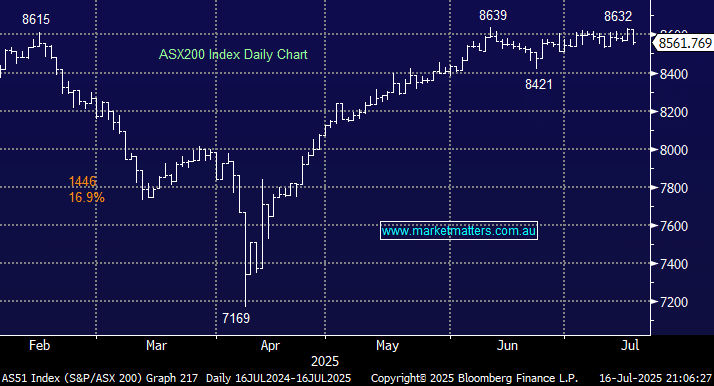

The ASX200 took a 0.8% hit on Wednesday, its worst session since early May, with over 65% of the main board retreating. Rising long-term bond yields and ongoing uncertainty around tariffs proved too much for a market striving to post new highs. The local market has now spent more than a month rotating between 8400 and 8600 and we continue to believe there’s a good chance of a test/break of the lower end of the trading range as we head into seasonally weak August and September – remember over the last decade these two months have delivered an average decline of more than 3%.

- Local stocks retreated after US inflation data (CPI) showed signs that tariffs are beginning to push up prices, supporting fears that the trade war would ultimately hinder the US economy.

This week saw the release of the latest Bank of America Fund Managers Survey, and it painted a mixed picture in our opinion, with the market starting to look comfortably bullish/long, no great surprise with many global markets posting or at least testing new highs in the last fortnight. The survey shows the last three months saw the biggest spike on record for risk appetite, which does get a touch unsettling:

- Investor sentiment surged in July to its most bullish since February, driven by the biggest jump in profit optimism in five years and a record surge in risk appetite.

- Cash levels fell to 3.9% from 4.2% in July, a level that triggered an in-house “sell signal” from the BofA strategists, i.e. a contrarian indicator.

- Fund managers are holding their biggest overweight position in the Euro in 20-years as they continue to abandon the US Dollar.

- Long gold and the “Magnificent Seven” were the other two standout crowded long positions—we will have a quick look at the latter in todays report.

In line with our comments above, we don’t believe the markets are set to roll over, but a 3-5% pullback feels like a coin toss at this stage. Remember, we remain bullish, looking for a “3 steps forward, 2 back ” advance into Christmas, and we are looking to be buyers of dips.

Overseas markets were mixed overnight, with the US advancing while Europe struggled. The German DAX slipped 0.2% and the UK FTSE 0.1%. Conversely, in the US, the Dow closed up 0.5% higher and the S&P 500 0.3% in a volatile session dominated by rumours around whether President Trump would fire Fed Chair Jerome Powell. The market ultimately took solace from the President’s statement that he has no plans to fire the central bank chief.

- The SPI Futures are calling the ASX200 to open up 0.6% this morning following the strong close on Wall Street.

We looked at Citigroup (C US) on Wednesday, and after Goldman’s stock traders posted the largest revenue haul in Wall Street history overnight, we thought it was time to cast the net wider across the space.