What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

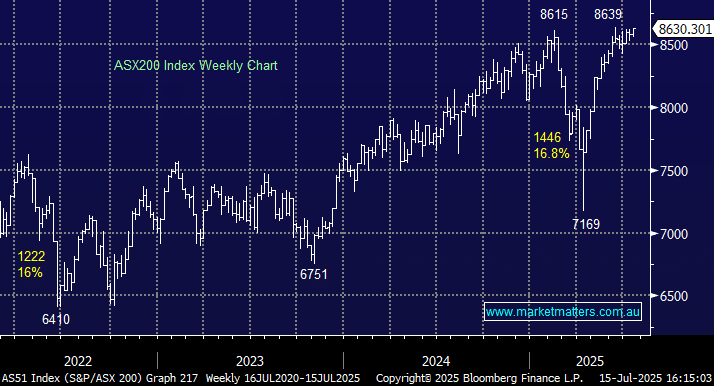

The ASX200 surged +0.7% on Tuesday following broad-based gains, which saw 70% of the mainboard close higher. The index posted a fresh record closing high for the second time in a fortnight, ignoring plenty of negative news along the way. Ironically, the only sector which slipped on the day was the materials even after China reported better-than-expected quarterly economic growth, although we wouldn’t be surprised to see this translate to some buying in the miners into August. Similarly, a pick-up in consumer confidence didn’t help the retailers, with Premier Investments (PMV) -1.4%, and JB Hi-Fi (JBH) -0.9% catching our eye in the “losers enclosure”.

Irrational exuberance is starting to gather momentum. Last night, the front page of the AFR featured the headline “Bitcoin tipped to climb as high as $US200k this year as inflows surge.” We wouldn’t consider fading this week’s surge to new all-time highs, with the Trump family so heavily invested in the crypto space, but it is the first bullish headline we’ve read in a while, and this makes us more cautious! The best-known crypto hit a record $US123,205 on Monday as the “crypto week” kicked off in the US. Congress is set to debate and, in all likelihood, pass a series of crypto-related bills in the coming days, providing clearer regulation for digital assets, which would further legitimise the booming industry. The ASX-listed VanEck Bitcoin ETF (VBTC) is up ~20% year-to-date as the animal spirits throughout the space remain entrenched; however, as we saw with the RBA last week, risks are elevated when expectations are high:

- Several crypto-related legislative measures failed to overcome a key procedural hurdle in the House of Representatives on Tuesday, sending many stocks in the space and Bitcoin itself down ~4%.

The much-anticipated US CPI (inflation) data was tame overnight, but initial rallies in bonds and stocks reversed as bets increased that the Fed will keep interest rates on hold, at least for now. The probability of a cut in September fell to an almost 50-50 coin toss. Underlying US inflation rose in June by less than expected for a fifth month, as lower car prices helped offset gains in other goods exposed to tariffs, but excluding cars, core goods prices climbed 0.55% in June — the biggest monthly advance since November 2021. Bonds, unlike stocks, are not wearing rose coloured glasses with long bond yields an increasing concern for stocks – more on this later.

Overseas markets were mostly weaker overnight as bets for Fed rate cuts waned, weighing on the broad market. In Europe, the EURO STOXX 50 slipped 0.3% while the UK FTSE dropped 0.7%. In the US, the Dow fell 1% and the small-cap Russell 2000 Index fell 2% while the tech-based NASDAQ eked out a +0.1% gain courtesy of a 4% surge by AI behemoth Nvidia (NVDA US), with clearance to again sell chips into China.

- The ASX200 is set to open down 0.7% this morning, wiping out yesterday’s gains, following a mixed bag of US earnings overnight and losses across bond markets.