Fingers on the pulse, this market’s getting interesting! (OZL, NCM, TLS)

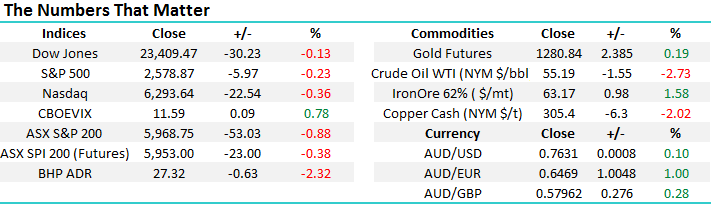

Like clockwork, the ASX200 has rolled over around the 10th of November with the catalyst this time being the large sell down of Woodside (WPL) shares by Shell, potentially sucking $3.5bn of short-term buying out of the local market. We should stand back and consider what may unfold over the coming 1-2 weeks if the market continues to follow its usual seasonal path:

1. Since the GFC, the ASX200 has on average corrected over 5% in November – this would target ~5750 with a more conservative 3% at 5870. This morning, the futures are implying an open ~5945, or 1.77% below last week’s high.

2. Since the GFC, Commonwealth Bank (CBA) has on average corrected over 6% in November – so far it only retraced $0.93 / 1.1% from Monday’s $81.56 high.

Overall following the ASX200’s +7% advance since early October, we remain bullish the local market for now and would be keen to allocate our 8.5% cash position into appropriate stocks if / when we get a decent pullback, but the above statistics clearly show there is no urgency just yet:

· We remain bullish the ASX200 into 2018, targeting a solid break over this 6000 area.

· We would need a break back under 5825 to lose this short-term bullish outlook.

Today we are going to concentrate on 3 important issues both within the market and our potential / likely investing plan over the next few weeks:

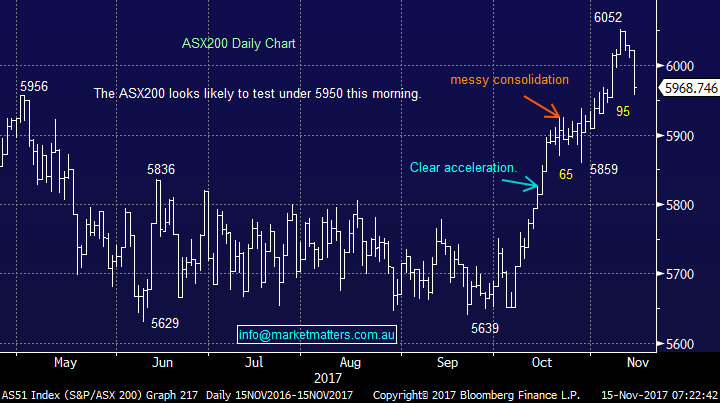

1. Copper and the base metal complex which looks to be under pressure.

2. 3 Potential sells within the MM Growth Portfolio.

3. Some potential buys for the MM Growth Portfolio.

ASX200 Daily Chart

1 Copper & the base metals.

Overnight the very influential copper price fell almost 2% leading to resource stocks coming under distinct pressure with BHP for example set to open down almost -2.5%. Although we are bullish the “reflation trade” and especially base metals, we currently only have 5% exposure via Independence Group (IGO) because on balance we see weakness from current levels with the Bloomberg Base Metals Index looking to be in the early stages of a ~7% correction.

Bloomberg Base Metals Spot Index Weekly Chart

There are number of potential targets we are watching in the space with heavyweights BHP and RIO clearly offering outstanding quality, but OZL also looks excellent on a risk / reward basis if buying ~$8.

OZ Minerals (OZL) Daily Chart

2 Three potential sells within the MM Growth Portfolio.

At the correct price, MM is not afraid to sell any of its shares as was demonstrated when we sold all of our CBA and ~50% of our portfolio close to the 6000 level in the ASX200 back in 2015 – a pretty unpopular move at the time. We have specified our profit targets for the likes of Aristocrat (ALL) and Challenger (CGF) over recent weeks, hence today we have covered 3 stocks that may also be in our selling cross-hairs but have not been discussed as often:

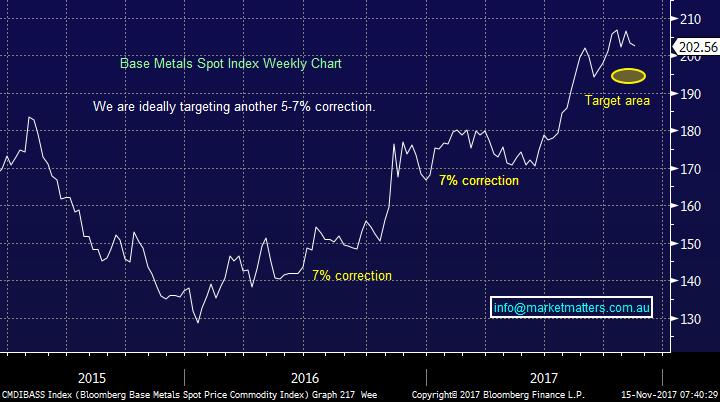

1 Newcrest Mining (NCM) $23.22

We are around square on our holding in NCM following its solid rally since early October. The $US Index has again turned lower which is usually positive for both gold and NCM. Ideally we will take a small profit on NCM between $24 and $25, but if it holds around current levels and the broad ASX200 falls we would consider a relative value switch moving forward.

The $US Index Weekly Chart

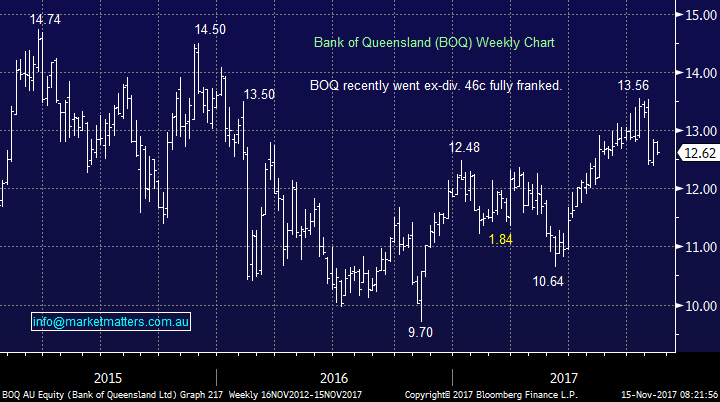

2 Bank of Queensland (BOQ) $12.62

We are showing a 5% profit on our BOQ position with the stock having traded ex-dividend $0.66 fully franked this month. We are considering switching this holding to CBA / CYB depending on relative prices in coming weeks with one eye on CBA’s dividend next February.

Bank of Queensland (BOQ) Weekly Chart

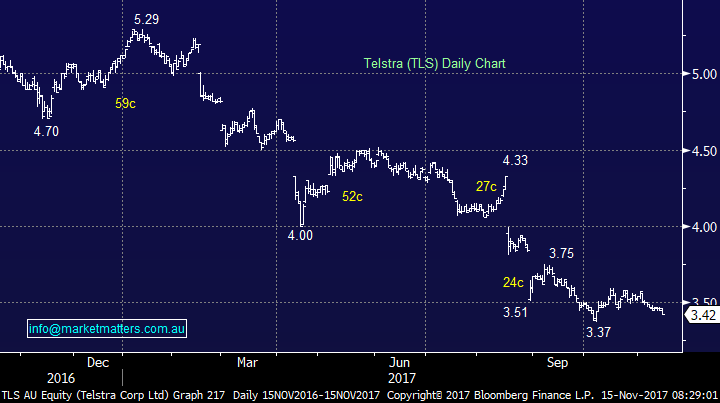

3 Telstra (TLS) $3.42

TLS has been friendless since August’s dividend slash, we are long and are currently showing a ~3% paper loss – probably better than a lot of the market but we still hate losing. The lack of interest from investors at current levels is not inspiring and we may take a loss on this position, especially if we see better quality stocks caught up in any general market sell-off; the next week will be interesting because the TLS of old virtually always outperformed in weak periods for stocks.

Telstra (TLS) Daily Chart

3 Potential buys for the MM Growth Portfolio.

We are always on the lookout for quality companies at attractive prices but this has been harder with the ASX200 rallying above 6000. However the current weakness may throw up some opportunities a few of which are touched on below, and in the Weekend Report:

- Banks – we are considering increasing our CBA position and / or buying into CYB Plc.

- Financials - we are considering buying into Macquarie (MQG).

- Resources – no change, we like BHP, RIO and OZL into decent weakness.

- Tourism – we like Crown (CWN) around $12.

- Retail – we continue to have interest in Harvey Norman (HVN) under $3.50.

Global Stocks

US Stocks

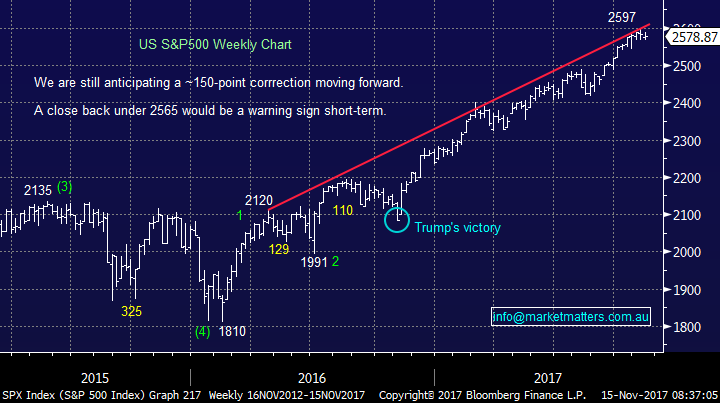

The US continues to oscillate around all-time highs and although we need a ~5% correction to provide a decent risk / reward buying opportunity, no sell signals have been generated to-date.

US S&P500 Index Weekly Chart

European Stocks

European stocks look to be failing after their recent break out to fresh 2017 highs, we are now neutral / negative the Euro Stoxx technically, following the break back under 3600. Notably at this point in time the fall has not been confirmed by the German DAX Index.

Euro Stoxx 50 Weekly Chart

Conclusion (s)

We believe the current market correction has further to unfold and we will be looking to re-jig our portfolio (s) into such weakness, a number of thoughts are outlined above .

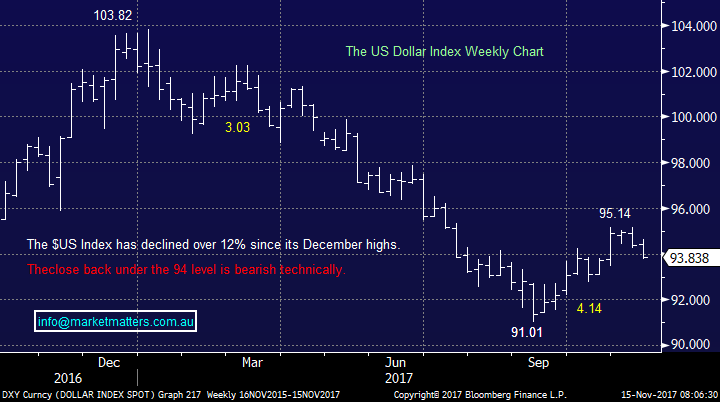

Overnight Market Matters Wrap

· The US equity markets resumed its recent retracement, with the indices ending its session in negative territory.

· US producer prices grew 2.8% in October, the highest rate in more than five years as energy prices were affected by Hurricane Harvey.

· Copper fell 2% on the LME while nickel weakened more than 5%. Oil is down 1.6%, while iron ore bucked the trend in commodities and rose 1.6%

· The December SPI Futures is indicating further weakness to be seen in the ASX 200, expected to open 23 points lower towards 5945 this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 15/11/17 8.00am

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here