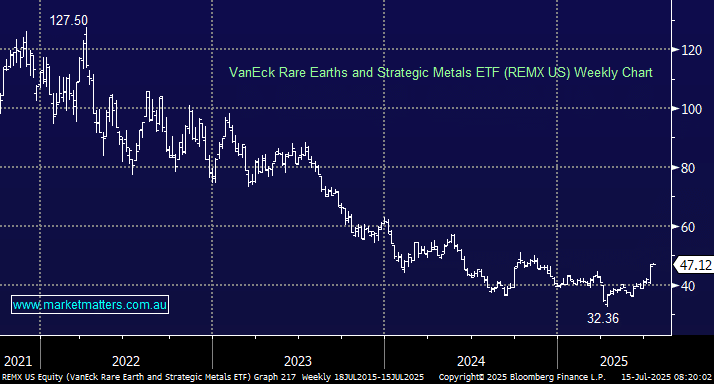

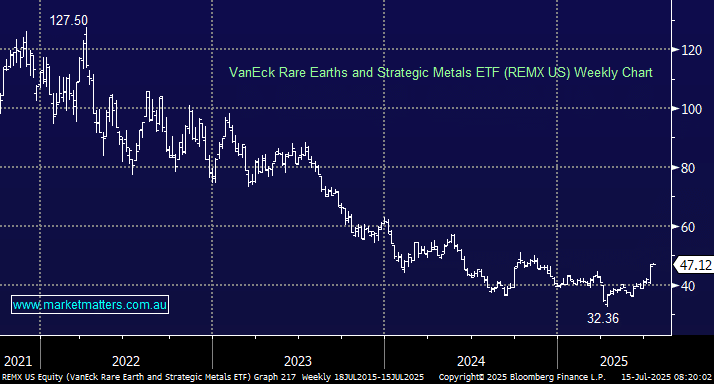

The VanEck REMX ETF is our preferred rare earths ETF, unfortunately, it’s not traded on the ASX but it’s a far purer play than the ACDC ETF which is more battery-tech focused. This ETF has a market cap of over $600mn as its aims to track the MVIS Rare Earth/Strategic Metals Index, which it does well: over the last 3-years, the index has returned 15.4% and the ETF 15.9%. The ETF costs 0.58% pa, but it provides access to a global group of 23 (currently) rare earth companies from China to the US and Chile. Currently, the largest five holdings are MP Materials 9.2%, China Northern Rare Earths 7.7%, Albermarle 7.6%, Lynas 6.9%, and Sociedad Quimica 6.3%.

- We like the REMX, believing the DoD has lit the fuse for the coming years.