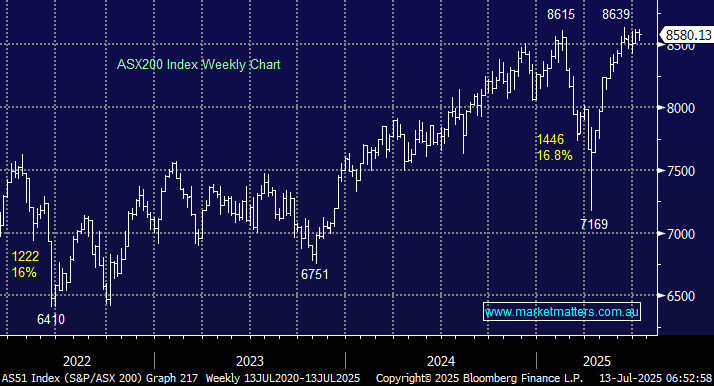

The ASX200 has been consolidating its impressive recovery from “Liberation Day” for the last five weeks, which is no surprise to MM. The action has been focused on the stock and sector levels, where things have been far from quiet. We maintain our bullish skew towards local stocks, but as we approach the mid-point of July and the index struggles to break above 8600, we are becoming increasingly close to adopting a short-term neutral stance. Our “best guess” target for 2025 remains the 8800-9000 area, which is only ~4% away, and with the RBA failing to deliver the largely expected 0.25% rate cut last week, the local market is looking increasingly tired around current levels; a test below 8400 wouldn’t surprise.

- On Saturday morning, the SPI Futures were calling the ASX200 to open down 0.2% today, although BHP gained another 20c in the US – we feel a fall closer to 0.3-0.4% is more likely today