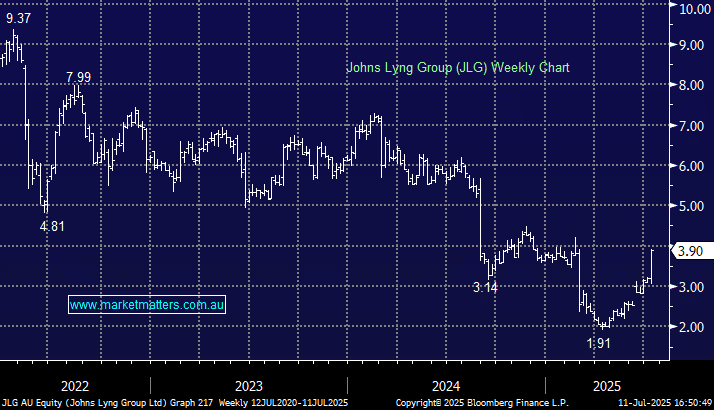

JLG +22.64%: Rallied strongly today after we finally heard the price that private equity firm Pacific Equity Partners (PEP) are willing to pay to take it off the boards. At $4/sh, this was above our expectations of $3.50 and we view the valuation as a good one, representing a 57% premium to JLG’s closing share price as at June 6, the last trading date before they announced the receipt of the conditional and non-binding indicative proposal from PEP.

The board has unanimously backed the bid, which is all-cash, fully funded, and just needs shareholder approval +some of the usual regulatory approvals for such a deal to complete. We think there is a high chance the deal completes at this price, hence the slight 10c discount shares closed at today.