Frustrating, we bought the wrong oil stock! (STO, WPL, ORG, OSH)

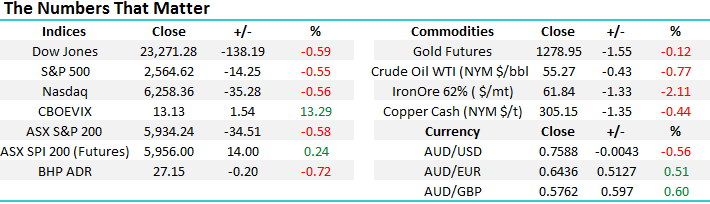

The ASX200 continued to embrace its seasonal weakness yesterday, falling another 34-points / 0.58% with the brunt of the selling focused in our resources sector. Yesterday’s fall took the correction to 118-points / 1.9% in just 4 days, already approaching half of the usual ~5% pullback in mid-November. We remain bullish the ASX200 following its +7% advance since early October and are keen to allocate more funds into appropriate stocks if this current downturn continues.

When we stand back and look at the ASX200 since October, an eventual retracement target around 5850 feels logical - only another 1.4% below yesterday’s close. The internals of our market feel good, although we would be far more comfortable with our view if a local correction coincided with a ~5% correction in US stocks. Last night the Dow appeared to be “cracking” as it tumbled 165-points during its session, but there was no meaningful follow through it eventually closed down 138-points / 0.6%.

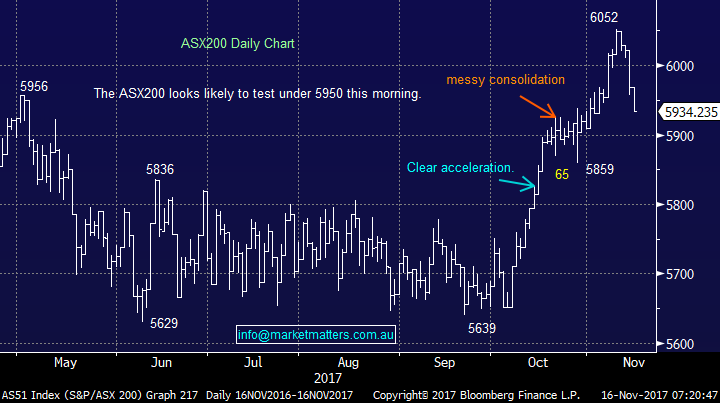

Today we are going to focus on the oil sector, following Big American oil’s reported $11 billion all cash offer for Santos (STO) anticipated to be around $5.30 a share, a healthy but not huge 21% premium to yesterday’s closing price.

Even with the Dow trading down 138-points, the ASX200 is poised to open up around +15-points this morning as fund managers contemplate the STO news and of course consider what to do with a potential bucket load of cash – if the STO bid goes through, it will release over 3 times the volume of cash that was sucked up by Shell’s placement of Woodside (WPL) a few days ago, a clear huge positive for local stocks considering the large negative impact that the WPL sell-down just had on our index.

ASX200 Daily Chart

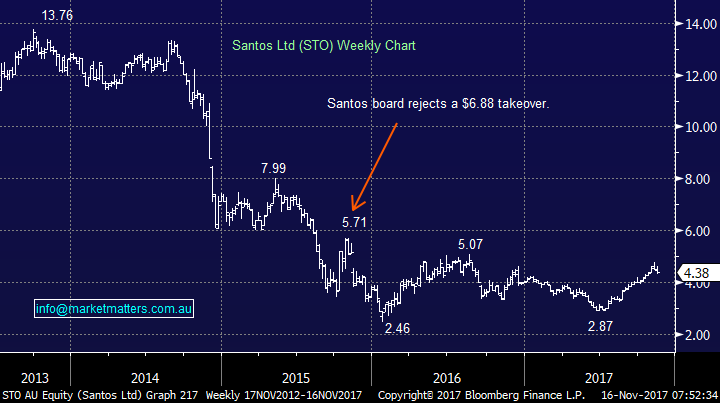

The Oil Sector.

As mentioned earlier, the Australian Financial Review (AFR) has led off this morning with news of a takeover bid by American Big oil for Santos (STO), the main takeout’s which we see are as follows:

- The bid is an $11bn all cash offer ~$5.30 per share.

- A 21% premium to yesterday’s close, but a modest 11% to last week’s high.

- In late 2015, the STO board knocked back a bid of $6.88 from Scepter Partners and instead raised equity.

- The STO board’s decision back in 2015, assisted by a weak oil price, led to a whopping 64% decline in the company’s share price.

Hence following the outcome of 2-years ago, we have to question whether the STO board will wake up today and attempt to achieve maximum value for its investors - who they work for! Let’s consider what the board may be considering over their scrambled eggs this morning:

- We knocked back $6.88 in 2015 and crude oil is now over 20% higher so $5.30 is not too exciting even though we issued more stock.

- Back in 2015 the energy sector was very out of favour as crude oil collapsed over 70%, but since 2016 it’s been relatively “hot”, gaining around 50%.

Back in 2015 we thought it was absolutely disgusting what the STO board did for its shareholders, this morning is not as straightforward. On balance we feel $5.30 is too cheap for STO with crude oil remaining strong well above $US50/barrel but will this board agree?

Santos (STO) Weekly Chart

ASX200 Energy Sector Weekly Chart

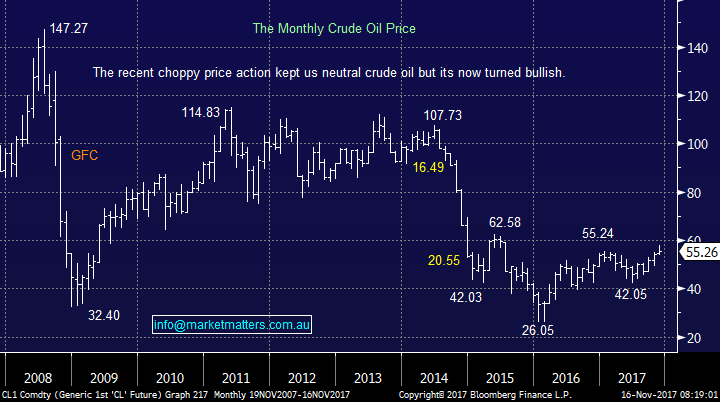

At MM we remain medium term bullish crude oil, potentially targeting close to ~$US70/barrel. This was one of the reasons this week we allocated monies into WPL for both the Platinum and Income Portfolio’s.

Crude Oil Monthly Chart

Let’s now update our thoughts on 3 of the market heavyweights in the Australian Energy Sector:

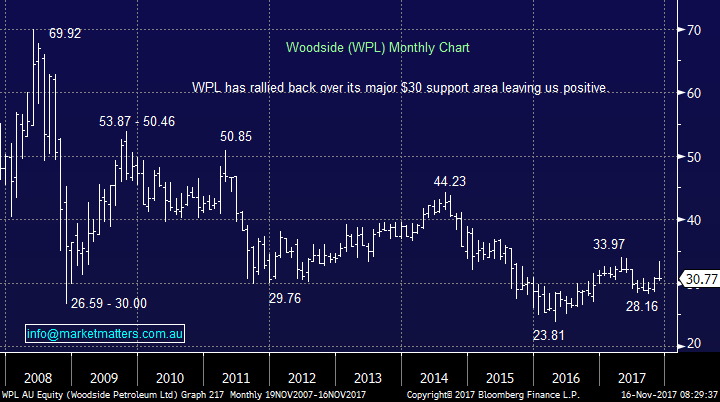

- Woodside (WPL) – We remain comfortable with our 3% allocation, although obviously it would have been nicer to have purchased yesterday when it was ~2% lower.

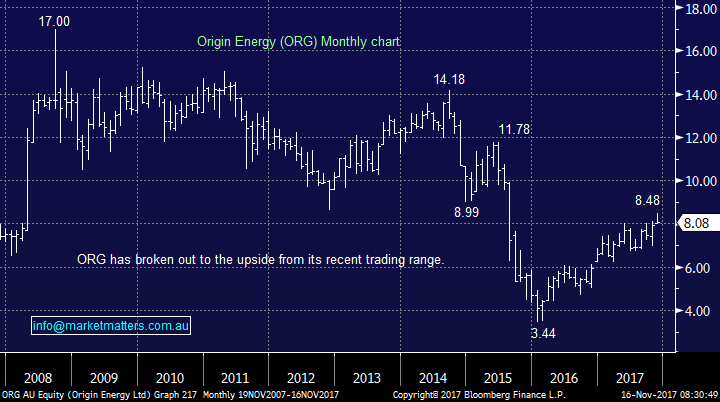

- Origin Energy (ORG) – We are not keen on ORG at current levels which has been a large outperformer in 2016/7, overall we see it as neutral / negative.

- Oil Search (OSH) – OSH remains neutral and has basically failed to move for ~2-years.

Woodside Petroleum (WPL) Monthly Chart

Origin Energy (ORG) Monthly Chart

Oil Search (OSH) Weekly Chart

Global markets

US Stocks

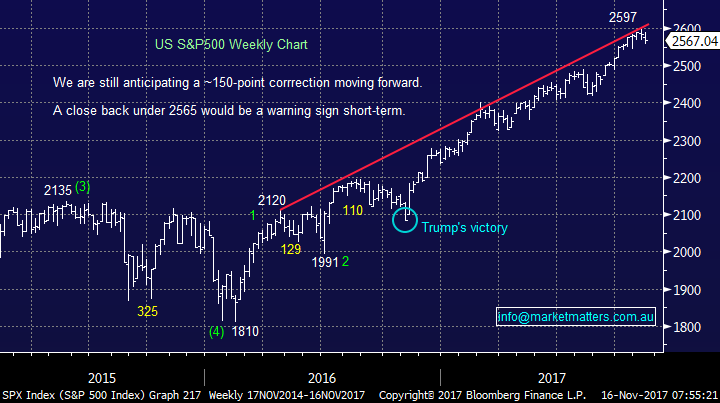

The US continues to oscillate around all-time highs and although we need a ~5% correction to provide a decent risk / reward buying opportunity, no sell signals have been generated to-date.

US S&P500 Weekly Chart

European Stocks

European stocks look to be failing after their recent break out to fresh 2017 highs, we are now neutral / negative the Euro Stoxx technically following the break back under 3600. Importantly last night, the German DAX Index confirmed the negative sell signals from Europe.

Euro Stoxx 50 Weekly Chart

German DAX Weekly Chart

Conclusion (s)

We believe the current market correction probably has further to unfold although a bounce feels likely, we will potentially be looking to re-jig our portfolio (s) into such weakness.

The outcome of the bid for STO is calculated guesswork, usually weighing up all the facts we would lean towards a failure but our confidence in the STO board is very limited so its probably best to toss a coin on this one!

MM remains comfortable with our recent purchase of WPL for both portfolio’s.

*Watch for alerts.

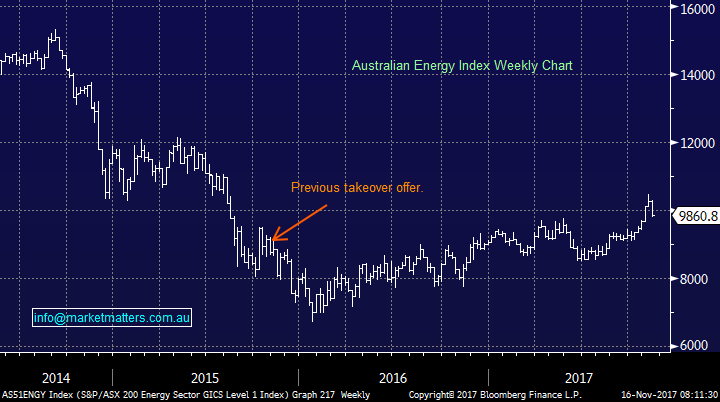

Overnight Market Matters Wrap

· The US share markets continue to slide from its game of snakes and ladders, with the major indices losing more than 0.5% overnight.

· Oil continues to hit a glut, with the oil futures settling down 0.77% as investors loses faith on an OPEC extension deal and a rise of US Crude stockpiles.

· BHP is expected to underperform the broader market today, after ending its US session down an equivalent of 0.72% to $27.15 after a double whammy of weak Iron Ore and Oil overnight.

· Santos (STO) is expected to outperform its energy peers after being approached by a consortium of energy investors for $5.30 a share.

· Expect a volatile open this morning due to November Index Expiry, with the December SPI Futures is indicating the ASX 200 to open 14 points higher towards 5950.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 16/11/2017. 9.00 AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here