- What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

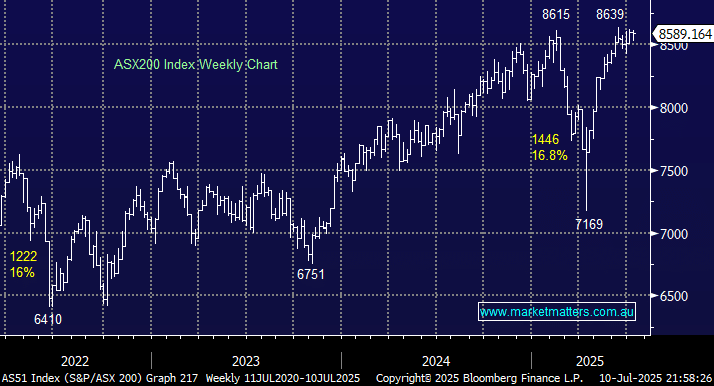

The ASX 200 closed up +0.6% on Thursday, a further 0.6% gain today, and it will post a fresh intra-day high. The rotation on the stock/sector level is currently chaotic, with yesterday’s moves largely a reversal of Wednesday’s, although the recovery by lithium names continues to gather bullish momentum. However, the most defining characteristic at the moment is that investors are happy to rotate their market exposure, but there is little to no follow-through on outright market selling. Almost 70% of the main board closed higher on the penultimate day of the week, with the influential heavyweight banks and resources on the up.

It was a rare day with the materials sector leading the line, closing up +1.24%. While the gold stocks dominated the winners’ enclosure, a +2.2% pop by iron ore was enough to drive the influential large-cap miners steadily higher throughout the session having started their day flat. If it wasn’t for some leftover selling of the copper names, the session could have been even more impressive:

- Regis Resources (RRL) +4%, Mineral Resources (MIN) +3.7%, Evolution Mining (EVN) +3.6%, Newmont (NEM) +3.2%, Fortescue (FMG) +1.9%, BHP Group (BHP) +1.2%, RIO Tinto (RIO) +1%, and Capstone Copper (CSC) -1.4%.

It wouldn’t be a typical day without President Trump influencing the markets’ performance, and in Thursday’s case, it was on the sector level with the healthcare stocks coming under pressure as investors weighed up the risks of 200% tariffs on pharmaceuticals manufactured outside of the US. There’s more water to go under the bridge here, but we know markets hate uncertainty. We’re keen to increase our exposure to the healthcare sector, the only one of the eleven to be in negative territory year-to-date: it’s down 6.25% while the ASX200 is up +5.3%. Any news-driven panic-selling is likely to see MM add to our initial position taken this week in CSL.

Overseas markets were mixed overnight, the German DAX slipped 0.4% in Europe, while the UK FTSE enjoyed a strong day, advancing +1.2% on the back of a good move higher in commodities. In the US, the tech-based NASDAQ slipped 0.2%, while the S&P 500 traded to all-time highs, closing up +0.3%.

- The SPI Futures are calling the ASX200 to open up +0.3% helped by a ~80c gain by BHP Group (BHP) in the US.