- What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

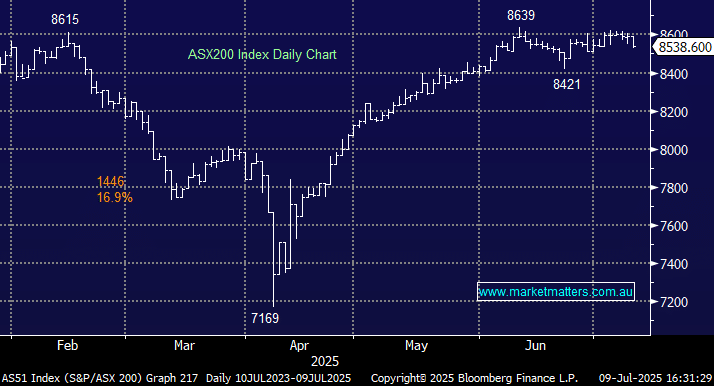

The ASX200 fell 0.6% on Wednesday, its largest decline in two months, as the market spent its 26th day rotating in a relatively tight 200-point range. However, while the index has been very calm for almost six weeks on the stock level, it’s been a very different story with the return of tariff uncertainty and the ever-changing perceptions around the future path for interest rates, spiking volatility across stocks – it’s just been a case of rotation between sectors instead of between stocks and cash. Yesterday was a fascinating day, although unfortunately, a few of our positions were clobbered as uranium, copper and gold stocks were pushed unceremoniously into the naughty corner, more on the last two later, but we remain buyers into the current pullback with our patience being rewarded, so far!

The lithium stocks are gaining more consistent support, and enjoyed a solid day in the sun, but they don’t move the dial on the index level. Conversely, market heavyweights BHP and RIO were both bucking the trend, trading positively at lunchtime, but sentiment was soured when China’s producer prices fell the most in nearly two years, adding to the urgency for Beijing to tackle deflationary pressures. Factory deflation persisted into a 33rd month, with the decline being the most since July 2023 and sharper than any economists had forecast. Chinese stocks initially rose after the data on speculation around more stimulus to ease deflation, but they drifted lower into the close. However, the local miners adopted a simple if in doubt, get out approach, with BHP reversing early gains to close down more than 1%, contributing over 12% to the index’s ultimate daily loss.

- We continue to believe the resources sector is looking for, or has found, a low, but the last few weeks have shown it might be an uncomfortable ride.

The RBA didn’t cut rates as expected on Tuesday, but interestingly, two of the traditional rate-sensitive sectors advanced, with the Utilities the pick of the bunch, closing up over 1%. The leading retailers also advanced, with 70% of the main names closing higher, led by Eagers (APE), Super Retail (SUL), Nick Scali (NCK) and Lovisa (LOV), who all closed up over 2%. Conversely, JB Hi-Fi (JBH) slipped 0.8%, and perhaps more reversion was at play as investors struggled to find value within the retail sector.

- We wouldn’t be surprised to see the ASX200 test under 8400 in the coming months. However, this market is not one to focus on the index; it’s all about individual stocks and sectors, and opportunities will present themselves.

Overseas markets were solid overnight with gains across the board. In Europe, the EURO STOXX 50 and German DAX both surged +1.4%, while the UK FTSE lagged, advancing just +0.1%. In the US, Microsoft (MSFT US) +1.4% was strong and traded above $US500 for the first time in history. We’ve held the view that MSFT will be a winner in AI, no matter what happens, and it remains a core holding in our International Equities Portfolio. Elsewhere, Nvidia (NVDA US) +1.8% also hit a new all-time high with 6 of the Mag 7 rising – Telsa (TSLA US) was the only exception. The tech-based NASDAQ advancing +0.7% while the S&P 500 closed +0.6% higher.

- The SPI Futures are calling the ASX200 to open up +0.5% this morning, reversing most of yesterday’s loss, with BHP closing up 10c in the US.

The volatility in the gold and copper stocks was huge on Wednesday with nine ASX200 gold stocks falling between 5% and 7% while copper play Sandfire closed down 3.5% having managed to recoup over half of its early panic morning lows. This morning we’ve updated our view on 3 stocks in the space as we get close to pressing the “Buy Button (s).”