Trump Tariffs

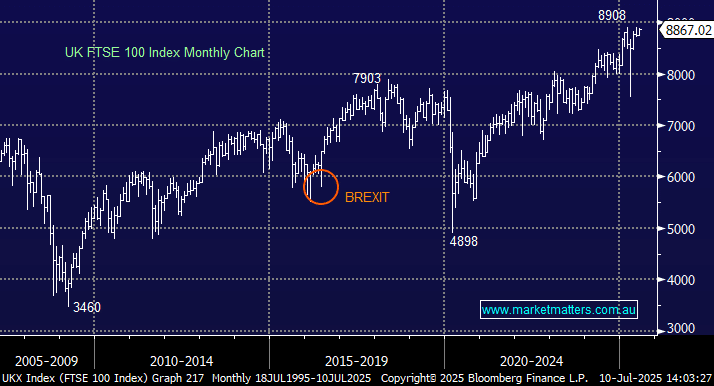

I note the comments of Andrew Hauser, Deputy RNA Governor reported in The Guardian " It is ‘puzzling’ investors are not more concerned by tectonic economic shifts emanating from Washington." Further he " warns of Brexit-scale impact as Trump threatens 200% tariffs on foreign pharmaceuticals." A former senior executive at the Bank of England, Hauser compared the tariff push to the experience of Brexit, to explain how it can take years for the full impact of major shocks to become clear. “The day after Brexit happened, everyone thought the world would end, and it didn’t. But 10 years on, you’re seeing the profound effects of some of those changes for sustainable growth rates and for fundamental things in the economy.” Does MM share these concerns and if so, how should we position for what is to come?