The ETF Ponzi Scheme

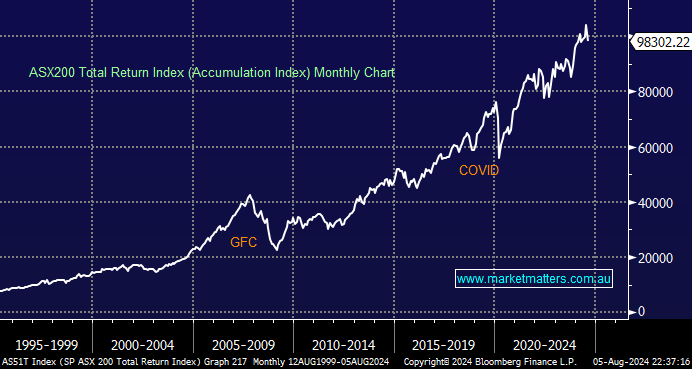

Hi Guys, I am sure I am not the only one concerned about the continuing seemingly unstoppable rise in Industry Index ETF valuations, with only minor drawdowns. Perhaps you can answer the mystery. For my part I think it has the hallmarks of a Giant Ponzi Scheme. Index Funds must follow the related index with Buy and Sell orders to closely follow the index. However, they also must create and redeem the number of units on issue in the ETF, according to the volume of Buy/Sell Orders received. Here in Australia we have an almost unique situation where the Superannuation Sector is subject to a rising minimum Contribution to Super now 11.5 % pa of workers Gross Wage. Much of this capital in continuing to roll into ETF's with both Insto's and SMSF's fuelling the growth in funds in ETFs, to record levels. Insto's must also maintain their weighting by market sector, causing them to increase their allocation of funds., many choosing ETF's to achieve this. This has distorted the Value and Yields of many market sectors and stocks. Witness the CBA with a Yield of 2.5% and our Banking Sector now the most expensive in the world.. But the ETF and Share price continue to rise?? Has the world gone mad?? What am I missing here? When and How do you see this Ponzi Scheme blowing up? Thanks James for your expert commentary