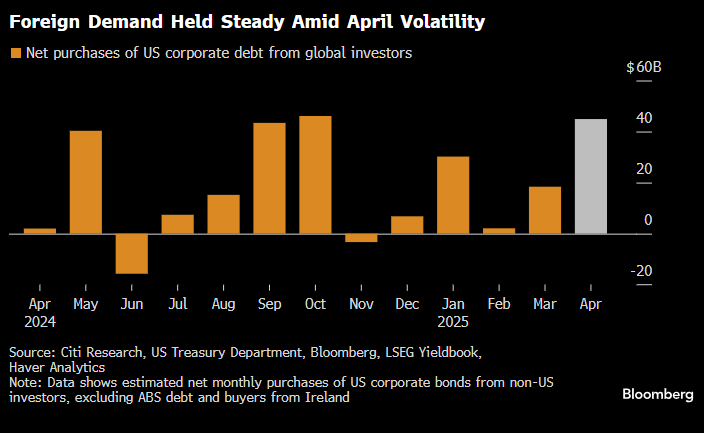

President Donald Trump’s proposed tariffs in April stirred fears that the era of global US financial dominance was over, and European and Asian money managers would cut back on buying US corporate debt. We may have witnessed a weak $US dollar, but foreign investors are still buying more American debt than they have in months. Overseas investors bought about $45 billion of US corporate notes in April, the most in six months, with the robust demand underscoring how powerful the status quo is – a strong corporate bond market is excellent for equity markets. To put things into perspective, there’s about $7.5 trillion of high-grade US corporate bonds outstanding, according to Bloomberg index data, more than double the size of its euro-denominated counterpart.

If investors do look to shift money out of the US, it will take them time to find and buy the securities they need. The US offers extraordinary diversification by sector, quality, and duration. On top of that, liquidity in the credit market has improved since the Federal Reserve stepped in as the lender of last resort at the height of the 2020 pandemic.

- While MM believes the status quo is slowly shifting away from the US towards Europe and especially China and India, the move will take years to unfold and will likely have a relatively low impact across portfolios in the near term.