Wall Street traders dodged a flurry of tariff headlines on Friday to drive stocks to all-time highs. This was helped by a group of large US banks comfortably clearing the Fed’s annual stress test, setting the stage for lenders to boost buybacks and dividends for shareholders. The 22 banks subjected to this year’s test remained above minimum capital levels in a hypothetical recession. The lenders would withstand more than $550 billion in losses, showing that large banks are well-positioned to weather a severe recession. Looking to push stocks ever higher, Donald Trump and Senate Republican leaders worked on Saturday to persuade reluctant holdouts to back the President’s multi-trillion-dollar tax and spending bill ahead of a pivotal vote. The weekend arm-twisting, which included some golfing between senators, came as the party worked to rush the bill to the president’s desk ahead of a self-imposed July 4 deadline.

Last week saw US consumer sentiment rise sharply in June to a four-month high, and inflation expectations improved as concerns eased about the economic outlook and personal finances – all good for stocks. According to the University of Michigan, the final June sentiment index increased to 60.7 from 52.2 a month earlier. The 8.5-point increase was the largest since the start of 2024. The bulls also enjoyed hearing China confirm details of a trade framework with the US, echoing US Commerce Secretary Howard Lutnick’s earlier comments about a US-China agreement – the tide appears to have turned on the news flow.

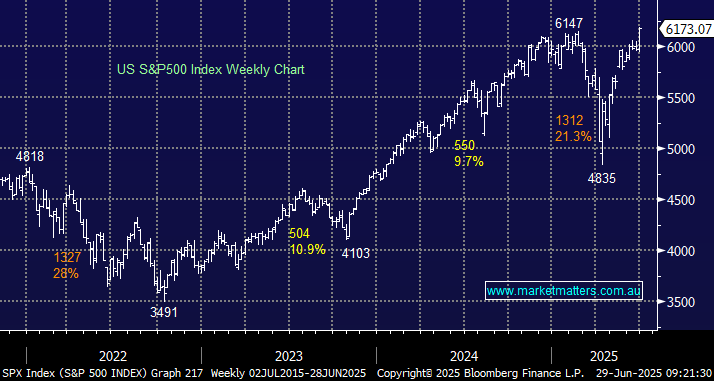

- We expect the S&P 500 to trade higher into Christmas, albeit in choppy fashion.