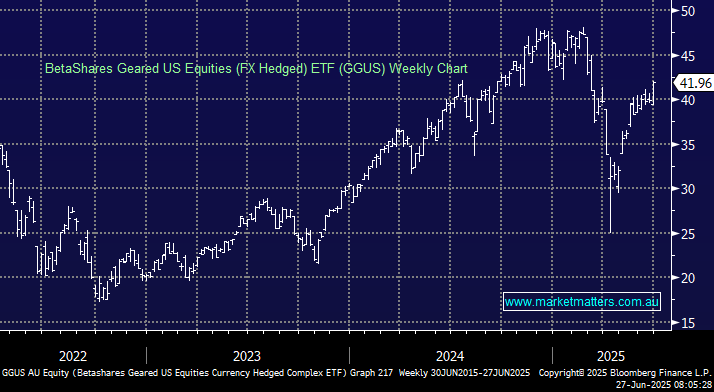

The GGUS ETF, traded on the ASX, is a bullish ETF for leveraged exposure to the broad-based US stock market; the ETF is hedged, so local investors have no exposure to moves in the AUDUSD. Fees are 0.8% pa, while dividends are paid once a year in June, where appropriate, but they were omitted in 2023 and 2024. This ETF is not for yield. Again, the real interest with the GGUS ETF is with its gearing, which is currently around 2.33x; hence, if the US S&P 500 Index goes up 1% today, the ETF would be expected to go up approximately 2.33% before fees and expenses. Note that the Fund is actively managed, and the gearing multiple will change slightly daily, affecting returns over time.

The ETF’s tracking of the US market is “okay” but not perfect. Over the last three months, the US Index rallied 1.82% while the GGUS ETF has gained 3.52%, around 1.9x. Also, it hurt investors when the S&P 500 plunged 21.1% into its April low, and the GGUS ETF fell 48%, illustrating that leveraged ETFs are not for the fainthearted.

- We like the GGUS ETF if/when we experience dips over the coming months, but the risk/reward of chasing strength at this stage is unappealing.