- What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

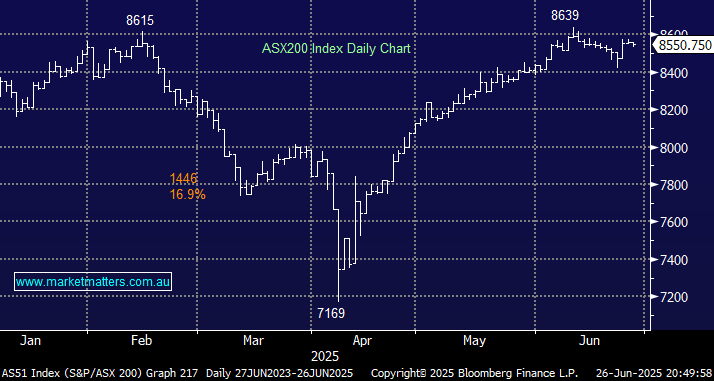

The ASX 200 experienced another quiet session on Thursday as the market followed the choppy consolidation, with an upside bias, that we expected at the start of the month. The local market ultimately slipped 0.1%, although over 55% of the main board closed higher. It was a rare day of weakness by CBA, plus a more than 5% drop by Xero (XRO) following its capital raise, which dragged the index into negative territory. XRO shares closed at $184, well above the $176 issue price of its huge equity raise to buy Melio, illustrating the market remains happy to “buy the dip” and, of course, its overall thumbs up to XRO’s acquisition to increase its footprint across the US.

- Note that as we enter the last two trading sessions of the FY, some volatile price action is likely.

The lithium stocks enjoyed a strong session into the last Friday of FY25 headlined by a strong in Pilbara Minerals (PLS), sending its share price up 5.6%, dragging other producers of the battery material along for the ride, with Mineral Resources (MIN) +3.6%, Liontown Resources +2.9%, and IGO +1.8%. Conversely, gold stocks continued to drift lower with Northern Star (NST) -2.3% and Regis Resources (RRL) -1.5% catching our eye; another 7-8% and we’re likely to increase our exposure to the sector across our portfolios. As we’ve discussed in the last fortnight, we’re looking for a trigger to start buying gold names, but with EVN down almost 25% from this month’s high, while gold has only slipped ~5% it still feels too early to add to our holding.

Overseas markets were strong overnight, with stock investors setting aside recent geopolitical fears amid hopes that a resumption of Fed rate cuts will bolster the outlook for the economy and corporate America; Treasury yields fell alongside the dollar. The S&P 500 advanced +0.8% while the tech-based NASDAQ again made fresh highs, closing up +0.8%. In Europe, things were more muted with the German DAX advancing by +0.6% and the UK FTSE by +0.2%.

- The SPI Futures are calling the ASX200 to open up +0.6%, testing the 8600 level, helped by BHP’s 80c gain in US trade.