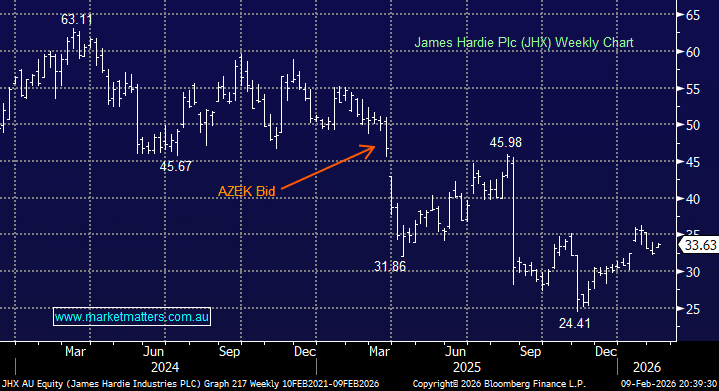

What Matters Today: President Trump may be about to create a tailwind for US housing

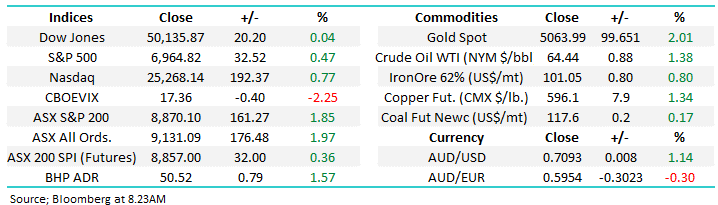

Monday saw the currently fickle ASX 200 surge +1.9%, its best trading day since April, just one session after it plunged 2%. Yesterday’s gains were broad-based with all 11 sectors advancing along with 90% of the stocks, while the tech, real estate and materials sectors all gained by 3% or more.