US listed CoStar Group (CSGP US) has entered into a binding agreement to buy the remaining 83% of Domain’s (DHG) shares it does not already own at $4.43 per share, valuing Domain at an enterprise value of around $3bn. NEC owns 60% of DHG, and after accounting for around $240m in capital gains tax liability, NEC will net ~$1.4bn, with the transaction likely to be finalised in 3Q25 after a shareholder vote in mid-August.

NEC has net debt of ~$480m, which will be paid back, and then they intend to pay a fully franked special dividend, estimated by NEC to be between 47-49c per share. Based on the mid-point, inclusive of franking, this is worth $68.5c. In the last half, DHG contributed ~30% of NEC group earnings (Ebitda), $77.8m of the total $268.4m and obviously losing that contribution is a negative, reducing the overall growth outlook moving forward. The offset is a balance sheet with net-cash and a renewed focus on their core business in free-to-air TV, streaming service Stan, publishing assets (The Age, The Sydney Morning Herald, AFR), and radio stations, with cash available to make strategic investments that are more complimentary to their existing operations.

- At the last update, NEC was making good progress on reducing costs overall, and with no debt to fund (post DHG sale completion), and more optionality moving forward, we think the deal makes sense for NEC shareholders such as MM.

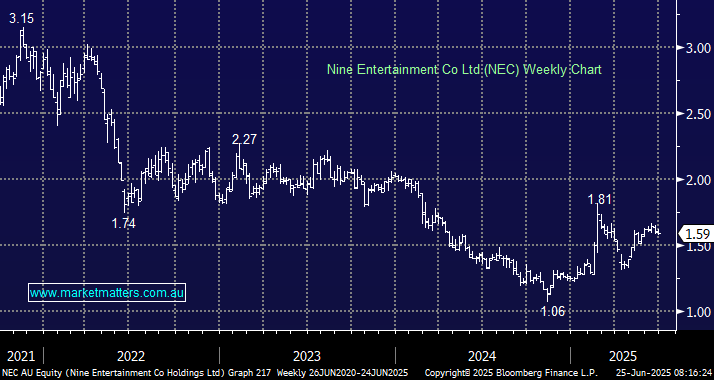

On back of the envelope calculations, the new Nine will have a market capitalisation of around $1.5bn, and should produce profit of ~$150m, with net cash on their balance. On an MM estimated ~10x earnings with optionality to grow, we think NEC continues to look interesting. For investors that can utilise franking credits, the special dividend of ~48c (fully franked) is also very appealing – MM holds NEC in the Emerging Companies Portfolio.