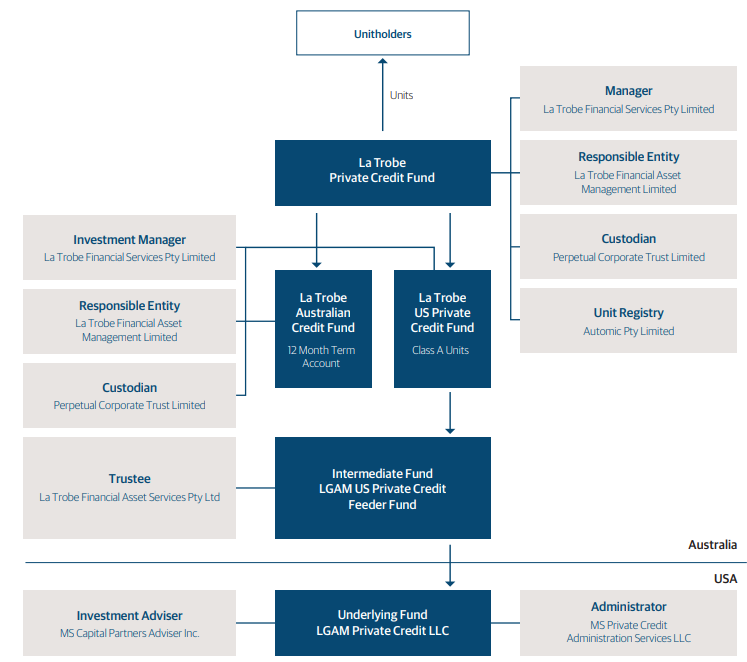

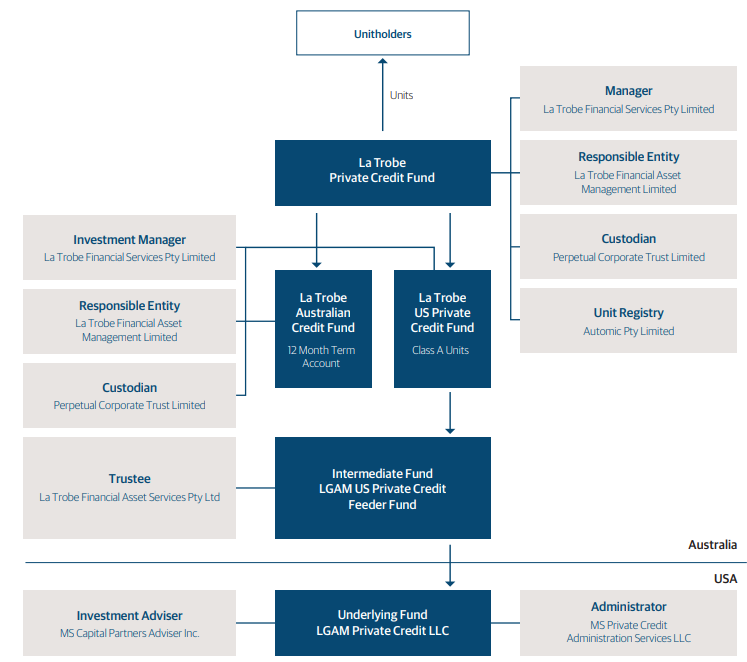

A new listing in the private credit space happens this Friday 27th June, with well-known La Trobe Financial listing it’s first ever fund on the ASX, having raised $300m in the IPO. The fund combines exposure to two of La Trobe’s strategies: the Australian 12 month term account and the U.S. mid-market corporate credit fund, which is actually a strategy run by a subsidiary of Morgan Stanley in the US (MS Capital Partners).

The 12 month term account is a well-known product that is advertised extensively. Many view it as a high-yield cash account, or a form of term deposit, but it’s worth recognising that it’s not, and carries higher risk than cash. The underlying assets held to support the yield are primarily a combination of residential mortgages, development finance and commercial property loans, plus a few other areas to a smaller degree. It has proven to be a good strategy over time.

- The MS Capital Partners component of the fund holds a portfolio of directly originated, senior secured first-lien term loans issued to U.S. middle-market companies. In other words, direct corporate lending in the US.

We think this is an interesting structure combining two solid managers that are staying within their area of competence; however, we are less positive on the fee structure of 2.02% per annum, and the return target of the RBA cash rate +3.25%, which equates to 7.1% pa. The fee structure is simply too high, in our view, and for investors targeting this sort of return, we believe there are better ways to achieve it; the Dominion Income Trust (DN1) discussed here is one example.

NB: LF1 lists on the 27th July