MA1 is a recently listed investment trust managed by MA Financial Group (MAF), investing in private credit targeting a return of the cash rate +4.25% per annum. We view MA as good managers, and this listed vehicle is a solid way of getting exposure to private credit via a listed/liquid structure. While only early days, the monthly income generated since March equates to a 12-month (unfranked) yield of circa 8.8%. The trust has a management fee of 0.9% plus GST, however, it invests in underlying MA funds that can have performance fees within them, suggesting the total fee structure is more likely to be around 1.3% per annum, which is the upper limit of our comfort zone for this type of product.

They invest in three key areas of private credit:

- Direct Asset Lending: Which are senior secured loans to owners of real assets, such as real estate.

- Asset-Backed Lending: Financing a portfolio of assets, like loans or receivables, with collateral and structural protections. An example would be a credit instrument backed by a portfolio of property loans.

- Direct Corporate Lending: Loans to established businesses, secured over the business, its assets, and cash flows.

Investing in these sorts of assets is more about avoiding losers than picking winners, and we place a high degree of importance on the manager’s track record and alignment. MA have a good track record over a long period, are a listed company on the ASX (market cap of $1.4bn), and importantly, MA staff have co-invested over $220 million in their private credit strategies, including $180 million in the underlying funds of MA1, on the same terms as we would.

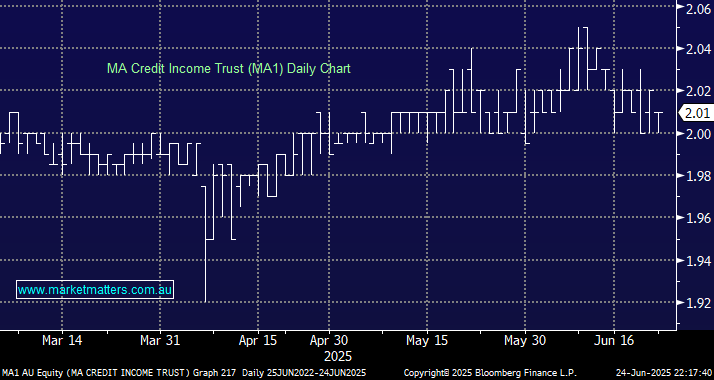

MA1 has this week raised an additional $50m at the net tangible asset (NTA) value of $2.00 per unit, taking total funds in MA1 to $380m, having upsized the initial raise from $300m to $330m (it was over-subscribed). It must be said, they were very quick to pull the trigger on an additional raise, but it’s hard to blame them if the demand is there. The underlying portfolio has around 180 different exposures across the three areas outlined above, returns are floating (rather than fixed), with around 90% of the investments in Australia and New Zealand.

There is always a risk that these types of securities trade at a discount to their NTA, and we’ve seen several different techniques managers have employed to reduce that risk, the best we’ve seen being the Dominion Income Trust (DN1) which has employed a fixed term for the vehicle, where-by the structure is wrapped up at a set date in the future (6-years from launch), much like a hybrid. While MA1 does not go as far as this, it does have various mechanisms in place, including regular off-market buybacks of units, on-market purchases by MA Financial entities, and on-market buybacks by the fund itself.

- All in all, we view MA1 as a solid private credit exposure, currently yielding nearly 9%, issued and managed by a solid organisation with a good track record.