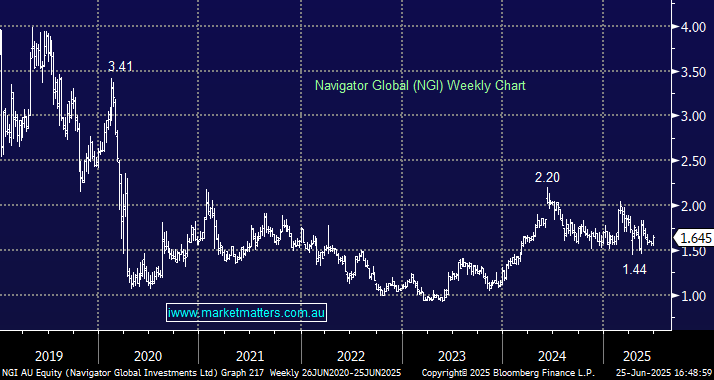

Navigator Global Investments (NGI)

Dear James & Shawn Thank you for your wonderful insights. I would like to hear your views on Navigator Global (NGI). As a big fan of alternative asset managers (KKR, BN, BAM, CG, APO & BX), I like NGI's business model of investing in alternative asset managers. It has around USD 120 billion AUM, so it's not small. And as I look at the numbers, there are so much going for it, yet the market seems to completely overlook it. This is a company with great growth, an excellent ROE, an earnings yield of 25%, which has doubled its earnings over the last 3 years, yet it is trading at a P/E of 4 and a Price/Book of 0.7x. What am I missing? Looking forward to reading your response. Thank you and kind regards Lambertus