Looking for value in yesterday’s 5 worst performers (WEB, CCL, A2M, CTD, AHY)

Happy Friday to all our subscribers as volatility continues to raise its head in different areas while most major stock indices remain relatively quiet i.e. The American VIX, or “Fear Index” continues to trade under 10%, close to all-time lows.

However, 2 things caught our eye yesterday that reminded us that 8 ½ years into a bull market is not the time for complacency:

1. China’s stock market suffered its worst one day sell-off in almost 1 ½ years yesterday on concerns of rising bond yields and toughening corporate regulation.

2. On a calm unchanged day, the ASX200 still witnessed 5 stocks fall by over 3%.

While at MM we believe that it’s not time to throw in the towel on this major bull market we would make 3 observations:

1. Slowly but surely the financial press is getting more optimistic for 2018 /9 which gives MM confidence a decent top is on the horizon.

2. We believe the mature position of this bull market is ripe for selling strength and buying weakness, hence today’s report - it’s not the time to buy a stock looking for 25% gains over the next 3 years unless you can find the occasional needle in the proverbial haystack.

3. When stocks do “roll over” the most pain is likely to be felt in the low-quality end of town – of those that are over owed by weak longs, the stocks typically shown on spivvy TV adds!

Short-term local stocks look capable of pulling back towards 5860 strong support before the Christmas rally / window dressing period will be upon us.

ASX200 Daily Chart

The main 2 catalysts we can see on the horizon for a stock market correction are:

1 – Chinas economy going through an unexpected slow down, with interest rates having almost doubled in just 1-year it becomes a possibility - that would certainly slow things down in Australia.

2 – Global inflation remains subdued which is not what central bankers want but if it actually turns around and rallies too fast the impact on stocks could be a worry.

Chinas AAA Corporate Bond yields Daily Chart

Yesterday’s 5 weakest stocks

1 Webjet (WEB) $9.79

Last time we looked at WEB we were bearish targeting a potential fall towards $9, the stock has now fallen 15% this month and ~$9 is within striking distance. The fall in the online travel booking site was triggered by a trading update with earnings guidance coming in short at $80m, compared to the $89m that analysts were expecting.

The fall is a classic example of what happens to a stock trading on a high valuation which suddenly disappoints the market. However, we do not see major concerns within the business at this stage and the current P/E of 20.8x Est 2018 earnings is rapidly becoming more attractive – the 1.78% fully franked dividend is clearly not exciting at this stage, it’s all about potential capital appreciation. One of the themes we’ve witnessed in more recent times is follow through selling on downgrades for a few days after. The WEB downgrade happened on Wednesday, following through selling yesterday and often stocks find a low on the third day.

We are considering buying WEB under $9.50.

Webjet (WEB) Monthly Chart

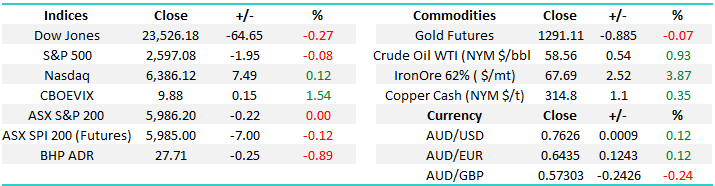

2 Coca-Cola Amatil (CCL) $7.59

No change, we have been bearish CCL since our inception and remain so. Sugar drinks are not the future even if I enjoy the occasional coke! We will need to see a distinct change in corporate direction for this stock to appeal to MM.

Coca-Cola Amatil (CCL) Monthly Chart

3 a2 Milk (A2M) $7.60

we’ve had a great result from a2 Milk this month, but subscribers are asking what are our thoughts / plans now? Let’s go to simple bullet points:

1. We like the A2M business and company outlook, especially within China but at what cost?

2. A2M is trading on an Est. P/e for 2018 of 37.5x leaving clear room for disappointment.

3. However, our main concern is the whole market appears to love the stock and is long, who is left to push it through $8 without fresh news?

The volatility within the stock is growing rapidly with yesterday alone seeing an almost 6% swing in the shares.

For now, we will observe but any weakness back under $6.50 is likely to see MM again accumulating A2M.

A2 Milk (A2M) Monthly Chart

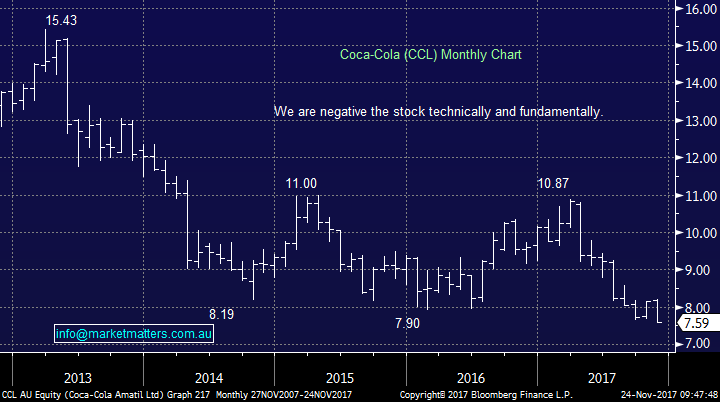

4 Corporate Travel (CTD) $20.77

This week CTD shares have fallen along with travel rivals Webjet (WEB) and Flight Centre (FLT) in what’s clearly been a tough few days for all concerned.

The stock will look interesting under $20 but we would prefer WEB under $9.50.

Corporate Travel (CTD) Monthly Chart

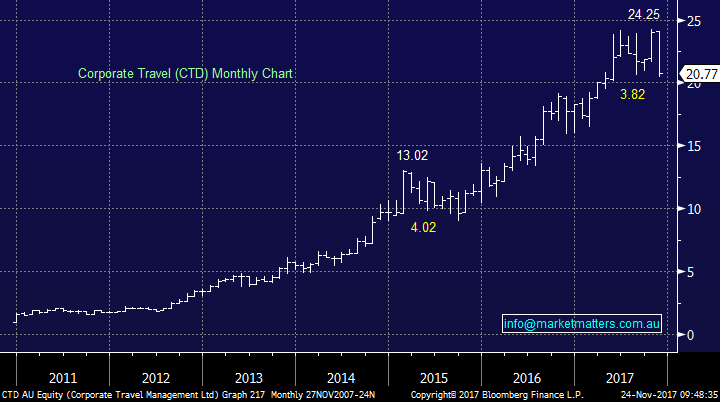

5 Asaleo Care (AHY) $1.47

This personal care and hygiene company continues to tread water since its listing back in 2014. The stock is trading on a fairly conservative valuation of 12.5x earnings for 2018 which shows the markets lack of optimism around growth.

We see no reason to consider AHY for our Growth Portfolio but its current yield of around 6.8%, partly franked, may make it an option for our Income Portfolio especially if / when we are bearish the general market as this stock clearly runs its own race,

Asaleo Care (AHY) Weekly Chart

Global Indices

US Stocks

US equities were closed overnight for Thanksgiving, moving forward from a trading perspective we would be happy to sell new all-time highs if / when they occur.

Overall there is no change to our short-term outlook for US stocks, where we would advocate patience ideally targeting a ~5% correction for the broad market to provide a decent risk / reward buying opportunity.

US S&P500 Weekly Chart

European Stocks

European indices were quiet overnight shrugging off weakness / volatility in Asian markets.

German DAX 50 Weekly Chart

Conclusion (s)

We are considering buying WEB under $9.50 for the MM Growth Portfolio.

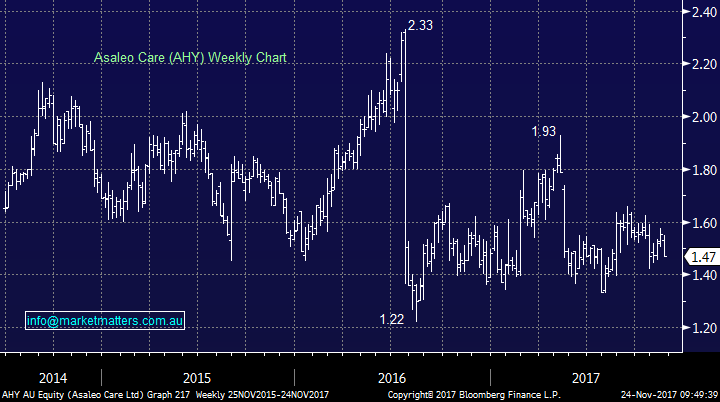

Overnight Market Matters Wrap

· Not much activity was seen in the US as they closed early with little change ahead of Thanksgiving.

· The Eurozone also had a lacklustre day and also closed with little change while Asian markets were weaker yesterday with the Shanghai index in particular under pressure, falling 2.2% on profit taking after its recent strong run.

· The iron ore price continued its recent recovery overnight, rising 3.87% to US$ 67.69/t and rallying ~15% in the last month on the back of continued strong global steel demand.

· The December SPI Futures is indicating the ASX 200 to open marginally lower, testing the 5980 level this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 24/11/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here