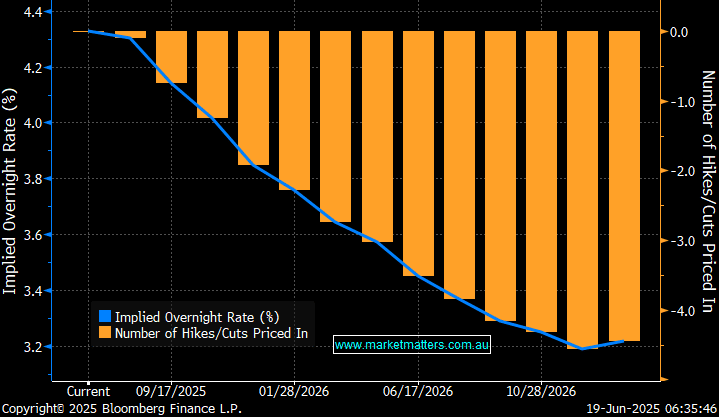

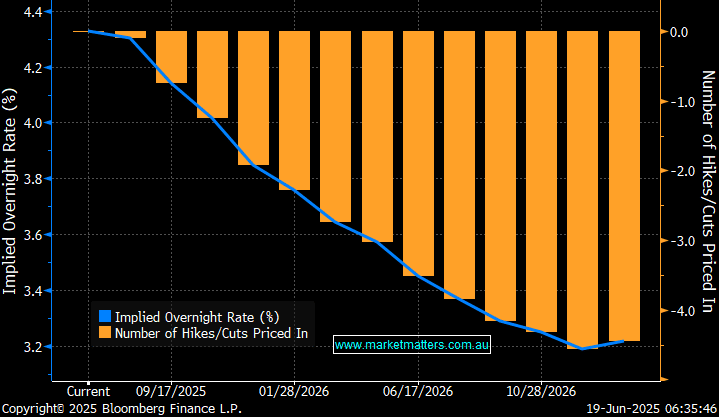

The Fed delivered a mixed message overnight, after holding interest rate steady as expected. They delivered a “warning” like hawkish message around inflation while still targeting two rate cuts in the 2H of 2025 – a bit of a contradiction! However, while they did say uncertainty around the economic outlook was high, it had diminished. The FOMC voted unanimously on Wednesday to hold the benchmark federal funds rate in a range of 4.25%-4.5%, as they have at each of their meetings this year. Officials also downgraded their estimates for economic growth while lifting their forecasts for unemployment and inflation; Chair Jerome Powell repeated his view that the central bank was “well positioned to wait to learn more about the likely course of the economy before considering any adjustments to our policy stance.”

- We believe the Fed’s on the money at present with two cuts likely before Christmas.