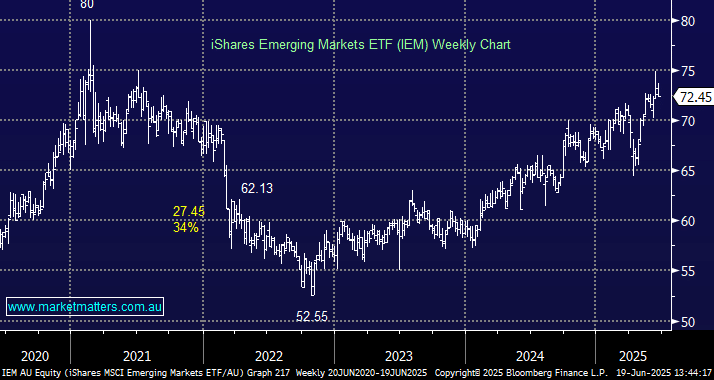

Emerging Market ETF’s

To the MM team, I would like your thoughts on Emerging Markets (EM's) and their role in a growth portfolio of ETF's. I do note that you don't hold any EM ETF's in your ETF Portfolio. Firstly, taking a medium term view what does MM think the risk return looks like for EM's vs say Europe or the US? Secondly, what ETF's would you consider buying in order to give good exposure to EM's? Lastly, which would you consider the better option an EM ETF or a more geographically focused ETF like INDA? Thanks for all the great content, Charles