- What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

NB: This weekend’s Q&A Report will be sent out on Sunday due to a Platform Upgrade.

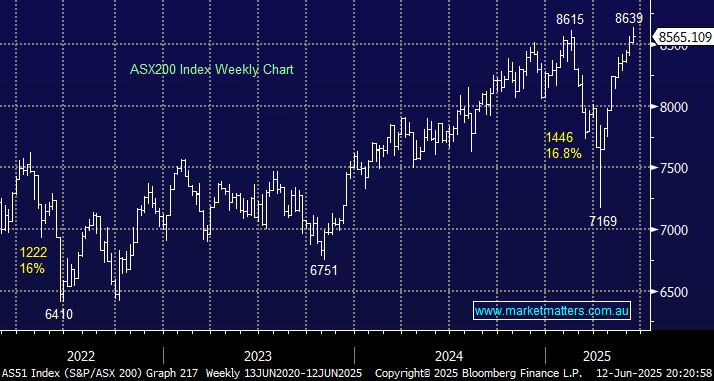

The ASX 200 surrendered early gains as “Trump tariff talk” weighed on the already “stretched” market. Ever since he’s heard the “TACO” phrase, the president has been talking a lot tougher. Only time will tell if the acronym is true or not, i.e. “Trump Always Chickens Out”. The index slipped 0.3% even with the winners outnumbering the losers, but when the banks and heavyweight resource stocks fall, the ASX will always struggle.

- US President Trump ratcheted up trade uncertainty with remarks that he intends to impose unilateral tariffs on dozens of US trading partners in the coming weeks.

As uncertainty spread across global markets, Asian indices also retreated, while the S&P 500 futures fell by ~0.5%, as trade jitters resurfaced, setting a broader risk-off tone across markets. However, we should not discount the uninterrupted +20% surge higher enjoyed by the ASX200 following the Liberation Day panic, as we’ve touched on a few times, some consolidation through June appears likely. As the $US dollar fell away following Trump’s threats, gold surged higher, dragging the sector along for the ride after a few days of aggressive profit taking:

- Genesis Minerals (GMD) +6%, Regis Resources (RRL) +4.2%, Ramelius Resources (RMS) +3.3%, Newmont Corp (NEM) +3%, and Evolution Mining (EVN) +2.4%.

The market dipped over 20 points into the close on fairly aggressive selling in the futures, and we now know this was likely a hedge for Brookfield’s $428mn sell-down of high-flying Queensland’s Dalrymple Bay Infrastructure (DBI) – MM owns DBI in its Active Income Portfolio. Shares in the coal port were being shopped around at $3.72, a 7.9% discount to the last closing price, with 115 million securities on offer. This represents about 23 per cent of the ASX-listed company.

Global stocks were firm overnight, primarily helped by a +13% surge in Oracle (ORCL US) shares following strong 4th quarter results, which showed ongoing cloud growth ahead, and the May Producer Price Index (PPI) rose just 0.1%, after decreasing 0.2% in April, supporting the case for interest rate cuts. The favourable inflation report helped push the S&P 500 up another +0.4%. In Europe, it was a mixed session with the German DAX falling by 0.7% while the UK FTSE advanced +0.2%.

- The SPI Futures are calling the ASX200 to open up ~0.6%, back above the psychological 8600 level.