REA has endured a tough 2025, especially when compared to its historical outperformance, and we believe it’s now at a fascinating juncture in its evolution with plenty of positives and negatives to consider:

- In March, rival Domain Group (DHG) received a “best and final” bid of $4.43 per share ($2.8bn) from US-listed giant CoStar (CGSP US), with the deal expected to close in the second half of 2025.

- In May, we heard the ACCC was investigating REA Group, the owner of real estate.com.au, for alleged price gouging.

CoStar looks set to bring some meaningful competition to our shores after DHG appeared comfortable playing second fiddle for years. The US giant has a market cap of ~$52bn, well above REA’s $32bn, suggesting at the very least it’s going to bring some firepower to the table to grab some market share from the established local leader. CoStar has actively acquired several real estate and property technology companies in recent years to expand its global footprint and digital capabilities, including Matterport for $US1.6bn, and OnTheMarket for GBP99mn. Investors shouldn’t underestimate the US company’s ability to weigh on REA’s margin in Australia.

Closer to home, the ACCC has confirmed an investigation is ongoing into REA, although the ACCC won’t comment further at this time. REA makes money by charging real estate agents a subscription fee and also charging thousands of dollars for each property listing, depending on how prominent agents want the listing to be and its geographical location. Listings can cost as much as $5000 in high-end suburbs. Each year, the company hikes the prices of its listings while its underlying subscription prices have stayed the same for the past 10 years. From July 1, however, REA has told agents it is increasing its subscription fees. Ironically, it’s the very powerful pricing power that’s propelled REA to what it is today, which could limit its local growth going forward.

- There’s a cycle evolving with companies/sectors that get too successful and come under the spotlight of the ACCC, like the banks and supermarkets. Pricing power can have a half-life when it affects the everyday Australian.

However, it’s important to recognise it’s not all bad news for REA:

- According to company figures, the site attracts more than 133 million average visits per month, almost four times more visits than rival Domain – hence the pricing power!

- More than 40,000 real estate professionals now use REA’s platform every month, enabling them to control more than 80% of the listing market.

- REA is expanding into India, with ~7% of revenue coming from the sub-continent in FY24, part of its global expansion plans.

- With the evolution of AI, REA will be in a position to charge real estate agents for leads, although they say they have no plans at this stage – watch this space as REA works out ways to grow revenue.

- Lastly, the gorilla in the room, as we all shop increasingly online, there is the possibility that REA cuts out real estate agents out of their own game, potentially enabling sellers to go directly through REA, etc.

It’s easy to argue that REA currently enjoys a monopoly; hence, CoStars’ bid for DHG makes sense for the consumer, and the deal should receive regulatory approval without difficulty. If the combination of the ACCC and CoStar start to squeeze REA margins as we suspect, this could apply pressure to REA’s high valuation. We think it’s clearly on the expensive side, not pricing in a rejuvenated competitor.

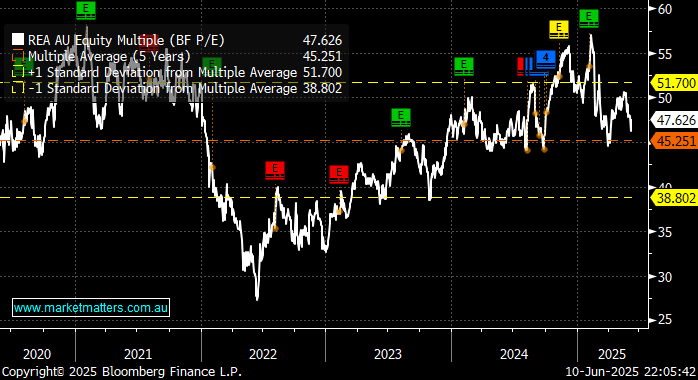

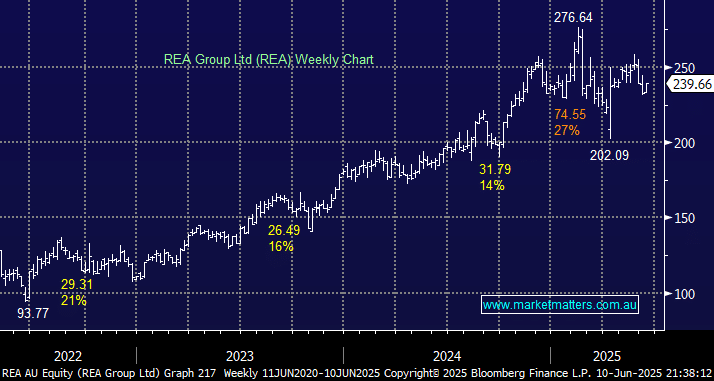

- While its valuation has come down, REA is still trading above its 5-year valuation even as the ACCC and CoStar headwinds loom.

We are conscious that when the ACCC investigated the banks, it gave brave investors an excellent buying opportunity; this could be the same with REA, but we see so no reason to chase the stock while it trades on the high side of its own history, given the competitive landscape could look a lot different in the next 5-years relative to the last.

- We like REA as a business, but it’s rich around $240, we would have more interest ~10-20% lower.