- What Matters Today in Markets: Listen here each morning or find all Market Matters Podcasts on Spotify.

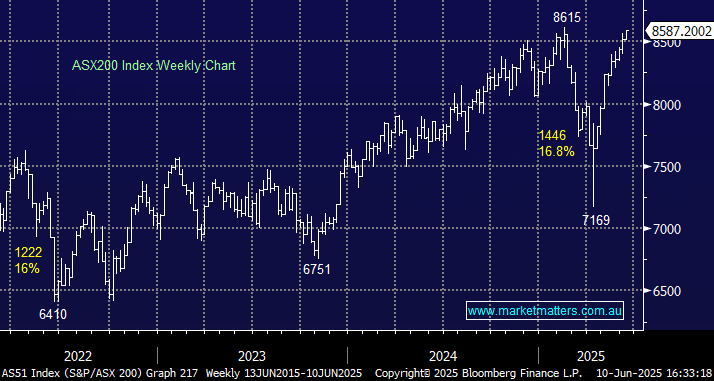

The ASX200 posted a record close on Tuesday as broad-based buying took the index up 0.8%, with the heavyweight financials leading the market higher; the “Big Four” gained an average of 1.2%. The market adopted a clear “risk on” theme as it approached all-time highs, while abandoning some of the year’s best-performing defensives, as underweight fund managers appeared increasingly exposed to the rising market. Optimism around US-China trade talks in London over technology and rare earth shipments was cited in the press as the primary catalyst for the day’s gains, but we’re leaning more towards FOMO (Fear of Missing Out) as global indices test/post fresh highs.

Winners: Zip Co (ZIP) +6.4%, Pilbara (PLS) +5.5%, NEXTDC (NXT) +5.2%, Mineral Resources (MIN) +5.1%, Magellan (MFG) +4.6%, Paladin (PDN) +3.6%, and Lynas (LYC) +2.4%.

Losers: West African Resources (WAF) -4.6%, Evolution (EVN) -3.8%, Newmont (NEM) -3.5%, Ramelius Resources (RMS) -1.4%, APA Group (APA) -0.6%, and Telstra (TLS) -0.4%.

With the EOFY only three weeks away, the jockeying for position has begun, and first out of that gate has been profit taking in golds and buying into the underperforming lithium and uranium names. Some of the rotation in the last five days has been dramatic:

- Mineral Resources (MIN) +37.3%, and Paladin (PDN) +22.3% compared to Evolution (EVN) -13.5%, and Regis Resources (RRL) -17.7%.

The aggressive unwind of the gold sector comes as no surprise to MM, having flagged the crowded trade a few times in recent weeks, another 8-10% lower, and we will be considering increasing our exposure. This could be one of several opportunities that unfold over the coming weeks as investors optimise their portfolios ahead of the end of the new financial year. So far, there have been no evident signs of tax loss selling, which June is often famed for.

Overseas markets were largely firm overnight, although the high-flying European bourses finished up mixed, with the UK FTSE advancing +0.2% while the EURO STOXX 50 slipped -0.1%. In the US, stocks gained after the Commerce Secretary said trade talks with China had progressed very well. The S&P 500 closed up 0.55%, within 2% of its all-time high, while the NASDAQ tech-based index was even stronger, gaining +0.7%.

- The ASX200 is set to open up around +0.3% this morning, around its all-time high, helped by a 50c advance by BHP in the US.