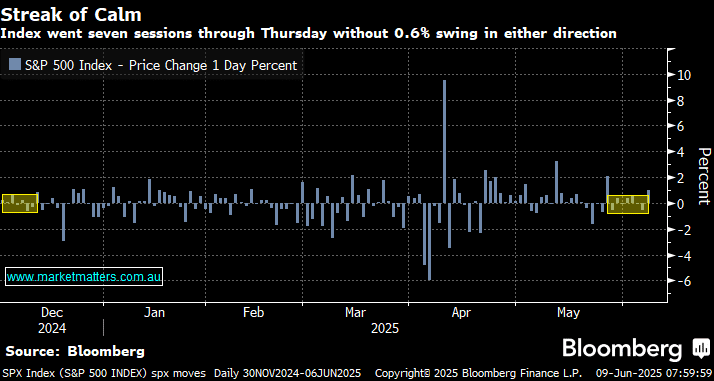

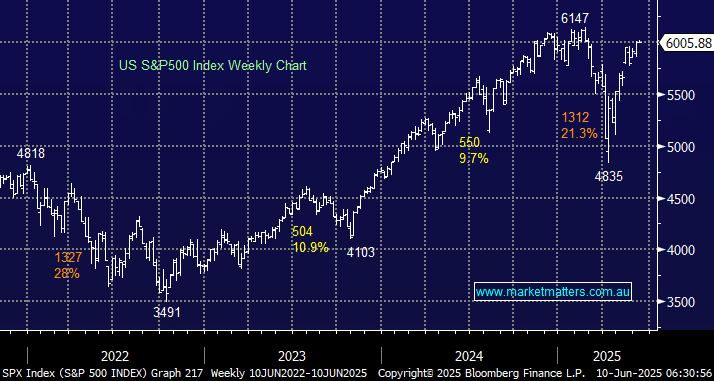

Stock traders see little to fear at the moment. Corporate America keeps churning out solid earnings. The chances of a recession aren’t blaring. And President Donald Trump’s tariff negotiations appear to be heading in the right direction. Before Friday, the S&P 500 hadn’t seen a move exceeding 0.6% in either direction for seven straight sessions — the longest stretch of calm since December, according to data compiled by Bloomberg. The bears would replace the word calm with complacency, but we believe it’s too early to search for excuses to migrate down the risk curve. With key inflation data due on Wednesday, fund managers are grappling with what could propel the S&P 500 back to a record after the index has already soared 20% from its April lows. We believe an underweight market is all that’s required.

- While the market continues to view all news through rose coloured glasses, stocks should remain firm.

Wall Street traders were glued to their screens overnight amid talks between the US and China which ultimately pushed stocks mildly higher, with officials hinting at progress in negotiations. With the S&P 500 trailing the MSCI All Country World Index excluding the US Index by almost 12% in 2025, its worst start to a year against its global peers since 1993, we can see some performance catch-up unfolding in the weeks/months, especially if the $US Dollar can stem its recent losses and trade talks improve to some degree – our preferred scenario.

- We are expecting stock and sector rotation, but overall, we are looking for the S&P 500 to punch higher.

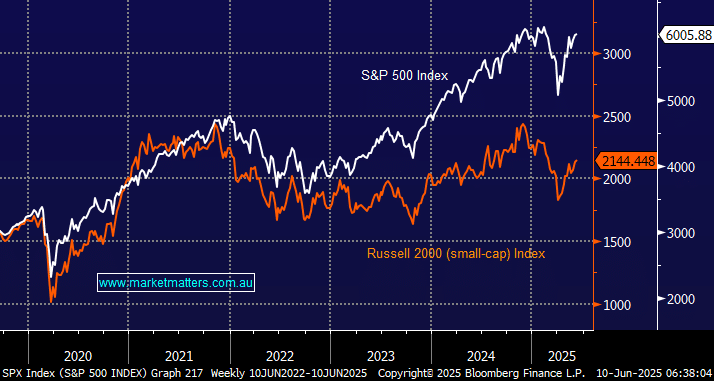

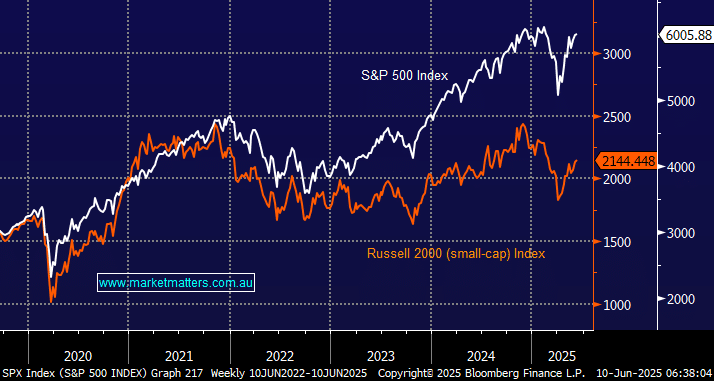

May was the best month for the S&P 500 Index in 18-months and the best May in 35 years. However, not all stocks, sectors, or indices have risen in unison, as we’ve discussed a few times lately. Investors have chased the “Certainty Trade” while leaving unprofitable tech stocks, for example, rooted in the naughty corner. If investors are going to push equity markets to fresh highs, they are eventually going to venture out of their comfort zone or risk buying good companies at crazy prices.

- We can see the Russell 2000 playing some performance catch-up in the 2H of 2025 relative to other indices.

If and when we see some FOMO (Fear of Missing Out) among investors across global stocks, which often heralds tops, the Russell 2000 small-cap index is likely to address some of its underperformance over the last few years – no signs yet.