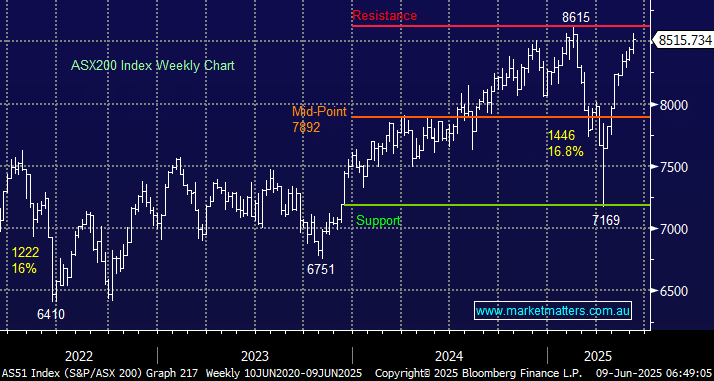

The ASX200 advanced +1% last week with the rare combination of financials and energy stocks leading the charge. Nothing has been “normal” about the last few months, but we can “play” with the numbers to get an idea of what the next few months may deliver:

- Over the last decade, the market has only declined once in June following a positive May, and July has been, on average, the best month of the year – the stats say ‘stay long’ the unloved bull market.

- We continue to look for stock and sector rotation to dominate through June & July, but the index surprises are likely to remain on the upside.

- Seasonally nimble investors may consider de-risking slightly through August and September.

If we consider what’s already been thrown at the stock market in 2025, it’s a testament to the strength of the bull market that new highs are so close. The National Guard has been on the streets of LA, and stocks keep marching on.

- The SPI Futures are calling the ASX200 to open up +0.3% this morning, back around 8550 after moves on Friday & Monday night.