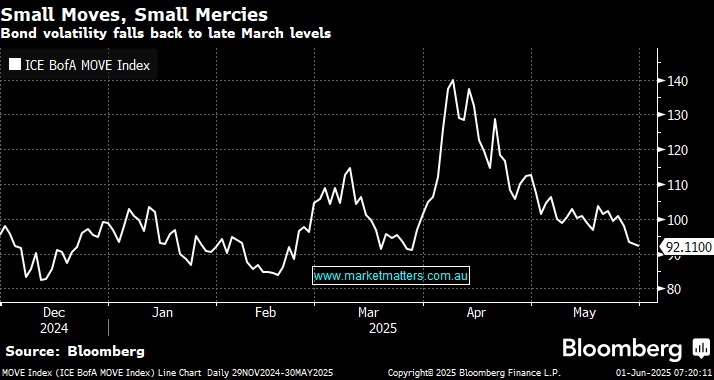

Bond market volatility has eased over recent months, although it won’t have felt like it to traders of long-dated bonds. Volatility in the US bond market has fallen back to where it was at the end of March, and the VIX has stayed well below April’s spike. It’s more surprising that bond volatility should be falling, too, after 20- and 30-year JGB yields climbed to the highest in a generation last week and the 40-year auction flopped. However, the global fallout was again limited and long-bond yields in yen, dollars and euros all ended the week lower. However, May saw Treasuries experience their first monthly loss of the year (yields rose).

The story of 2025 so far has been Trump’s tariffs and the markets’ rapid recovery as if nothing happened, leaving investors who sold aggressively post-Liberation Day and failed to buy back in well behind the proverbial eight ball. Last week, we saw a great example of once bitten, twice shy as traders reacted to news that the Court of International Trade in Manhattan had scuttled Donald Trump’s tariff policy with weary restraint. In these turbulent times, it’s essential to distinguish “signal from noise”, and the market seems to have decided that the Trump administration’s legal problems are noise.

- We can see bond market volatility remaining subdued into Christmas.