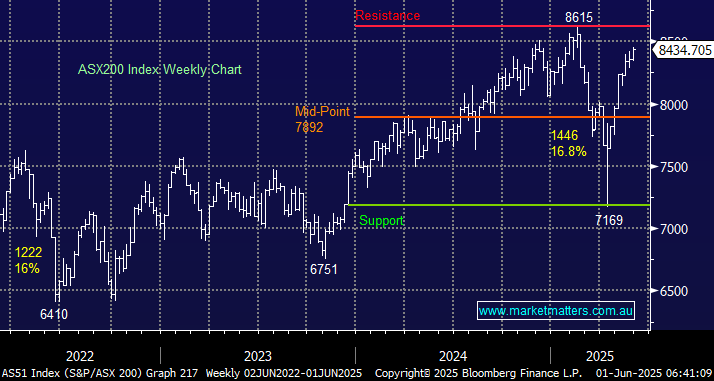

The ASX200 advanced +0.9% last week pushing the index within striking distance of its all-time. However, the upside momentum has been slowly diminishing through May. The market feels like it needs a “rest” before pushing back above 8600, but in line with the German DAX and Canadian TSX Composite Index we continue to believe it’s a matter of when, not if, we start talking about whether the local index can reach 8800, or even 9000, with the later likely to need our resources sector to regain their “mojo”.

- We are looking for stocks and sector rotation to dominate through June, but the index surprises are likely to remain on the upside.

The above views suggest that “risk on” should emerge as the outperformer in the 2nd half of the year, but we wouldn’t be chasing the market at current levels, it “feels” like a better than 50-50 chance that a pullback will unfold in the coming weeks, i.e. we are sticking with our mantra for 2025 of “Buy the Dip”.

- The SPI Futures are calling the ASX200 to open up +0.3% this morning, back above 8450.