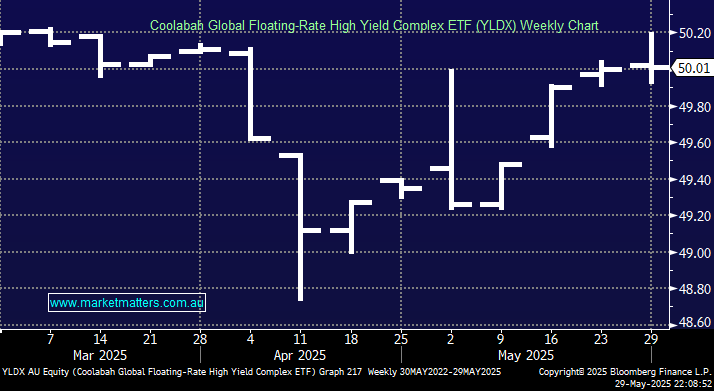

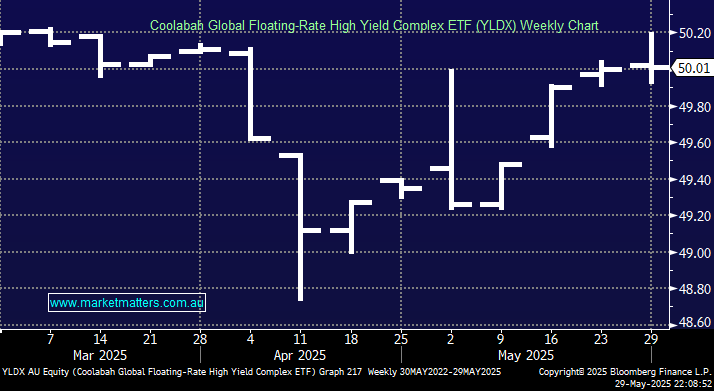

This is an interesting strategy, run by an interesting guy – Chris Joye! The YLDX is a very active strategy that aims to generate higher income than other traditional fixed income investments by investing in a floating-rate portfolio of investment-grade bonds and hybrid securities issued predominantly by global banks and insurers, and enhancing the yields through the use of gearing (or leverage) – higher risk, higher (potential) return.

Coolabah applies a bottom-up and top-down fundamental analysis of both the issuers of the securities and the credit quality and structural features of the securities themselves to build a portfolio of global cash and debt investments. Investors are effectively backing the Coolabah team to take advantage of mispricing in the market.

- Advantage: distributions are paid monthly, and the security has a running yield of 7.1%, but that’s before fees, which are high for a bond/fixed income product.

- Disadvantage: Considering a 1% fee structure, running yield is more like 6% and it’s geared. We question whether the added complexity of this security is providing enough of a return uplift versus more traditional (boring) securities.

That said, Coolabah are good managers, they’re just expensive.

- We are neutral YLDX, the fees look high considering the edge they have generated.