Hi Angela,

This is a business with many moving parts, run by Ryan Stokes. In our view, they are positioning themselves to be something like a mini Berkshire Hathaway, with a mix of diverse businesses with an industrial focus. Their recent investor day was very much focussed on deployment of capital and the things they look for, and we can’t help but think, this will be a business that performs well over the medium to long term – Ryan is a very good CEO.

In FY’24, its $10.6bn of revenue came primarily from 4 areas:

- Westrac 55% – SGH owns 100% of WesTrac, the sole authorized Caterpillar dealer in Western Australia.

- Boral 34% – SGH holds a 95% stake in Boral, Australia’s largest integrated construction materials producer.

- Coates 10% – SGH fully owns Coates, Australia’s largest equipment hire company.

They also own a 30% stake in Beach Energy and 40% of Seven West Media = very diversified!

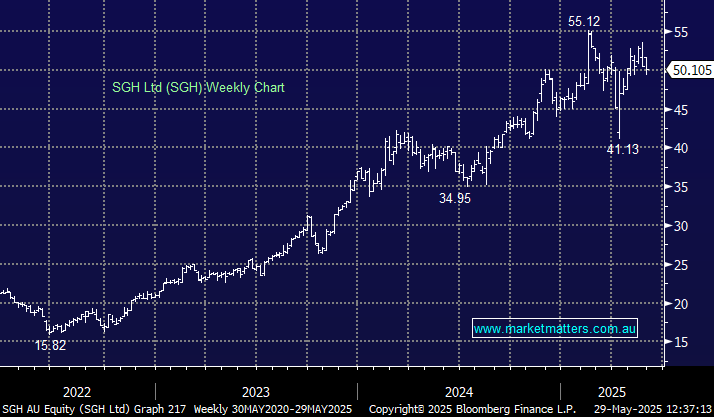

This is a quality business, it’s just very well owned, and the message that came from their recent update was they are looking to deploy capital i.e. buy something. With its valuation on the richer side of history, and the prospect of acquisition (s), we can understand why some investors have taken a few $$ off the table after a great run in recent years, but ultimately, we think this is a good business, run by a very good CEO, making us cautiously bullish around $50. If the market continues to perform, as we think it will, the pullback in SGH is presenting an interesting opportunity, and this is a stock we are keeping a close handle on.