Is Copper’s tumble a warning, or an opportunity? (OZL, BHP)

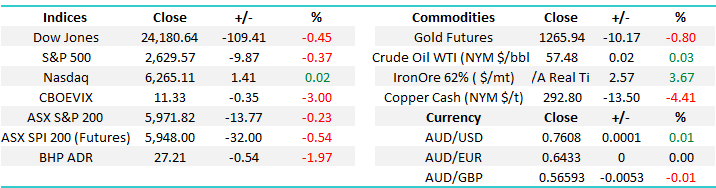

The ASX200 demonstrated signs of December resilience yesterday by recovering 2/3 of its early morning sell-off to close only -0.2% lower. Although seasonally the local market does not commence its Christmas rally until mid-December, when investors receive around $8bn in dividends from ANZ, NAB and Westpac, it’s a brave trader to go short in a month that has closed up on average +2.5% since the GFC.

Yesterday we saw the previously solid performing high valuation stocks sold off while the bemoaned retailers and Telstra rallied strongly in a great example that all trends come to an end at some stage. We are not calling the end of the bear market for the retail sector just yet but we do feel the easy money for the “shorters” has gone with Amazon now open for business, hence share movement will become more about actual performance than pure speculation and scaremongering.

Today we are going to focus on the resource sector following coppers 4.5% plunge overnight, almost its largest one day fall in 3-years.

ASX200 Daily Chart

Telstra (TLS) has rallied an impressive 8% from last week’s lows and a repeat of this advance would not surprise, at this stage we are considering selling our position in 2 halves at $3.70 and $3.80.

Telstra (TLS) Weekly Chart

Dr Copper gets smacked

Last night’s fall in Copper was blamed mainly on a stronger $US but that doesn’t sit particularly right with us at MM as the $US only rallied 0.15%, we feel optimism around the US tax cuts fuelling the global economy has got a little ahead of itself. The copper price is generally regarded as a leading indicator on the global economy and the recent 10% correction is at odds with most economists belief that growth is improving. There is certainly some debate going on about whether or not Copper will be in surplus or deficit in 2018/19, with most predicting a slight surplus in 2018 followed by a slight deficit in 2019, which means any price increase for now will probably come from a change on the demand side, or in other words, a more bullish growth outlook for the global economy.

We believe the risk / reward has returned for the bulls and while copper holds above the 275-280 region we can be buyers around $US290/lb.

Copper Monthly Chart

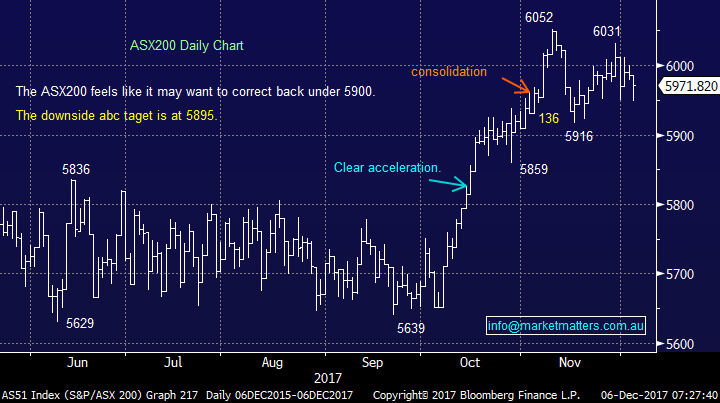

We have been watching the Base Metals Spot Index over the last month targeting a pullback to the 195 area for a buying opportunity and this was almost achieved last night.

Base Metals Spot Index Weekly Chart

The correlation between the copper price and US 10-year bond rates is not perfect but certainly worth acknowledging.

- We remain bullish US interest rates (bond yields) which implies global economic strength and higher copper prices.

Copper v US 10-year bond yields Weekly Chart

Two potential buys for the MM Growth Portfolio

1 OZ Minerals (OZL) $8.21

We’ve had some good success with OZL in 2017 and patience has played a pivotal role in this, today this willingness to wait is likely to be rewarded.

- We are bullish OZL on a risk / reward basis under $8 i.e. 2.6% below yesterdays close – note this is a relatively aggressive play. Watch for alerts today.

OZ Minerals (OZL) Daily Chart

2 BHP Billiton (BHP) $27.75

BHP is set to open down 2% this morning, around the $27.20 area. I have deliberately left the weekends notation on the below BHP chart as we we’ve had no interest in the “big Australian” near $28.

- BHP will now be attractive on a risk / reward basis under $26.50 / ~4% lower, assuming it can hold above $25.

BHP Billiton (BHP) Weekly Chart

Global markets

US Stocks

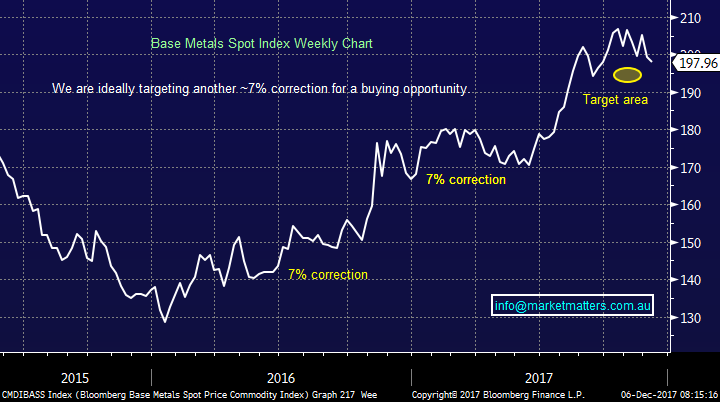

No change, we still need a ~5% correction to provide a decent risk / reward buying opportunity, no sell signals have been generated to-date but it’s clearly struggling above 2600.

The current strong rally since Donald Trump’s election adds to our confidence with buying a decent ~5% pullback.

US S&P500 Weekly Chart

European Stocks

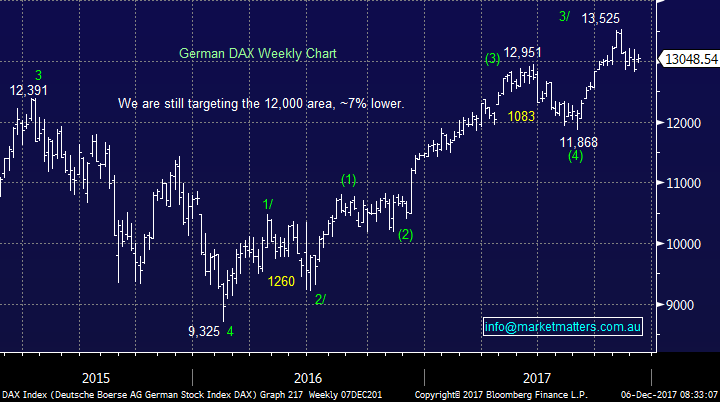

European stocks look to be failing after their recent break out to fresh 2017 highs, we are now neutral / negative Europe over the next few weeks.

German DAX Weekly Chart

Conclusion (s)

1 - We are buyers of OZL under $8 with stops under $7.50.

2 – We are buyers of BHP under $26.50 with stops under $25.

NB We usually use stop levels where we will cut our position for a loss with resource stocks because we regard them as more active vehicles of investment

Overnight Market Matters Wrap

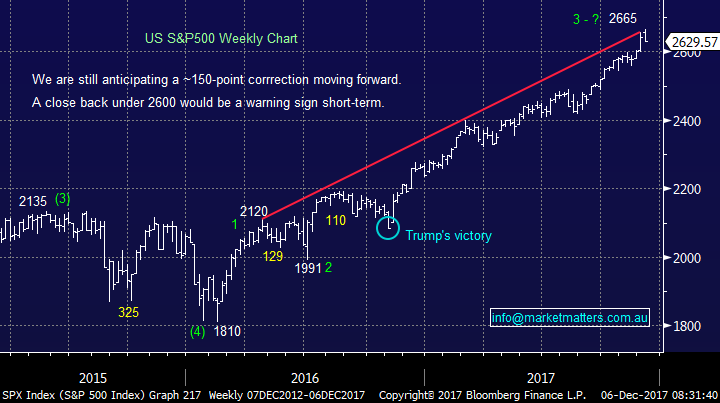

· The US Equity markets failed to hold onto early gains again, with the Dow and S&P 500 ending their session in the red, while the NASDAQ 100 was practically unchanged.

· The Australian market is expected to be under further pressure following a selloff overnight in industrial metals, with copper in particular down 4% - back below $3/lb for the first time in 2 months.

· Higher than expected LME copper stockpiles drove the metal lower and led to a selloff in global miners, with both BHP and RIO slumping 1.5% and 2.3% respectively. Gold was also under pressure down 1% at US$1262/oz., but the oil price went against the trend firming around 1%.

· The December SPI Futures is indicating the ASX 200 to open 27 points lower towards the 5945 level this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 06/12/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here