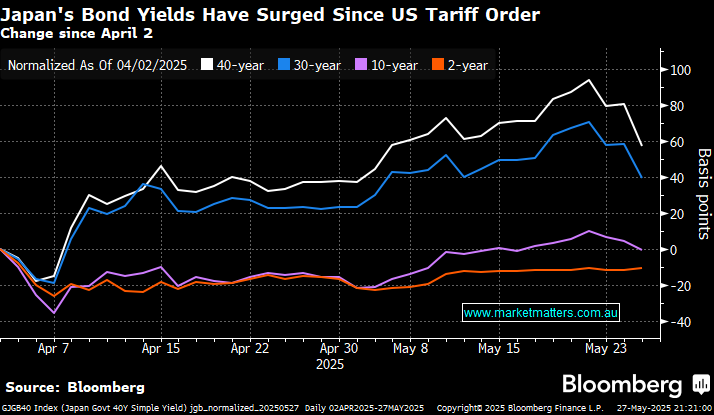

Bloomberg News reported on Tuesday that Japan’s finance ministry had asked market participants for their views on the appropriate amount of debt issuance. In other words, it’s looking to calm a market where relentless selling had pushed yields to record highs, leaving demand for fresh supply floundering. For global investors seeking to buy long-term debt, a reduced supply of Japanese government bonds could prompt them to consider alternatives in the European and US Treasury markets. The yield on Japan’s 40-year debt plunged around 25 basis points on the report, relieving some of the mounting pressure on long-dated bonds caused by President Donald Trump’s signature tax legislation and a Moody’s Rating downgrade.

We believe the move by the BOJ will ease the pressure on long-dated bond yields, removing the recent headwind from equities and other risk assets.